Page 36 - Investment Advisor April 2021

P. 36

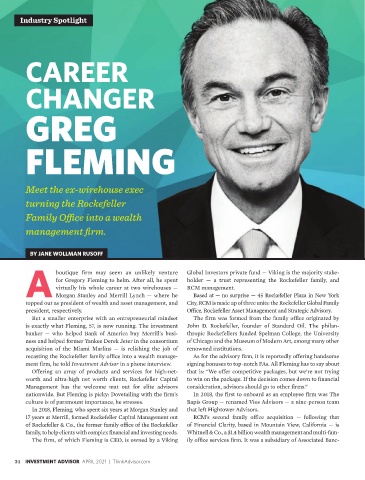

Industry Spotlight

CAREER

CHANGER

GREG

FLEMING

Meet the ex-wirehouse exec

turning the Rockefeller

Family Office into a wealth

management firm.

BY JANE WOLLMAN RUSOFF

boutique firm may seem an unlikely venture Global Investors private fund — Viking is the majority stake-

for Gregory Fleming to helm. After all, he spent holder — a trust representing the Rockefeller family, and

virtually his whole career at two wirehouses — RCM management.

A Morgan Stanley and Merrill Lynch — where he Based at — no surprise — 45 Rockefeller Plaza in New York

topped out as president of wealth and asset management, and City, RCM is made up of three units: the Rockefeller Global Family

president, respectively. Office, Rockefeller Asset Management and Strategic Advisory.

But a smaller enterprise with an entrepreneurial mindset The firm was formed from the family office originated by

is exactly what Fleming, 57, is now running. The investment John D. Rockefeller, founder of Standard Oil. The philan-

banker — who helped Bank of America buy Merrill’s busi- thropic Rockefellers funded Spelman College, the University

ness and helped former Yankee Derek Jeter in the consortium of Chicago and the Museum of Modern Art, among many other

acquisition of the Miami Marlins — is relishing the job of renowned institutions.

recasting the Rockefeller family office into a wealth manage- As for the advisory firm, it is reportedly offering handsome

ment firm, he told Investment Advisor in a phone interview. signing bonuses to top-notch FAs. All Fleming has to say about

Offering an array of products and services for high-net- that is: “We offer competitive packages, but we’re not trying

worth and ultra-high net worth clients, Rockefeller Capital to win on the package. If the decision comes down to financial

Management has the welcome mat out for elite advisors consideration, advisors should go to other firms.”

nationwide. But Fleming is picky: Dovetailing with the firm’s In 2018, the first to onboard as an employee firm was The

culture is of paramount importance, he stresses. Bapis Group — renamed Vios Advisors — a nine-person team

In 2018, Fleming, who spent six years at Morgan Stanley and that left Hightower Advisors.

17 years at Merrill, formed Rockefeller Capital Management out RCM’s second family office acquisition — following that

of Rockefeller & Co., the former family office of the Rockefeller of Financial Clarity, based in Mountain View, California — is

family, to help clients with complex financial and investing needs. Whitnell & Co., a $1.4 billion wealth management and multi-fam-

The firm, of which Fleming is CEO, is owned by a Viking ily office services firm. It was a subsidiary of Associated Banc-

34 INVESTMENT ADVISOR APRIL 2021 | ThinkAdvisor.com