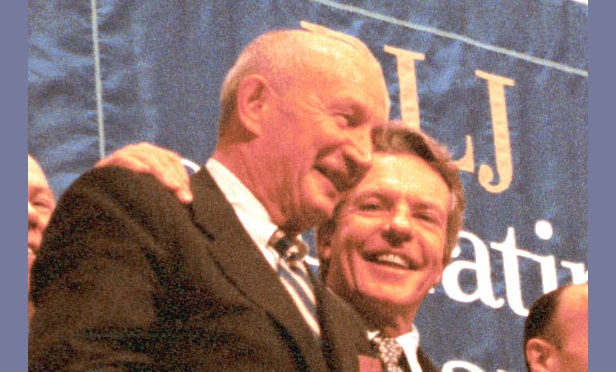

Richard Jenrette (left) stands with Dan Lufkin at the New York Stock Exchange on Dec. 9, 1999, while celebrating DLJ's 40th anniversary at the exchange. (Photo: Eileen Miller/BB)

Richard Jenrette (left) stands with Dan Lufkin at the New York Stock Exchange on Dec. 9, 1999, while celebrating DLJ's 40th anniversary at the exchange. (Photo: Eileen Miller/BB)

Richard Jenrette, a co-founder of the first New York Stock Exchange member to go public, the investment bank Donaldson, Lufkin & Jenrette, has died. He was 89.

He died on Sunday in Charleston, South Carolina, from complications of cancer, according to Margize Howell, co-president of the Classic American Homes Preservation Trust. Jenrette founded the trust in 1993 to preserve architecturally significant homes he acquired, including Millford Plantation and Roper House in South Carolina, Ayr Mount in North Carolina and Edgewater in New York, which he purchased in 1969 from author Gore Vidal.

With Bill Donaldson and Dan Lufkin, fellow graduates of the Harvard Business School, Jenrette opened the firm known by the shorthand DLJ in December 1959. It first made a name for itself by providing research on growing companies not then covered by most of its Wall Street competitors — firms such as Xerox Corp., one of its first "buy" recommendations. Before long, it had a client base loaded with pension funds, mutual funds and other institutional investors.

(Related: 3 AXA Equitable IPO Answers)

"Institutions were paying massive sums in brokerage commissions and getting nothing back for it," Jenrette recalled. "So we offered them some real research for their commission fees. They were so tired of giving business to Merrill Lynch and other firms that they began to put business into us." He was quoted in "What Goes Up: The Uncensored History of Modern Wall Street as Told by the Bankers, Brokers, CEOs and Scoundrels Who Made It Happen," a 2005 book by Eric J. Weiner, now an editor at Bloomberg News.

DLJ grew as mutual-fund sales, and their attendant commissions, took off in the 1960s. Jenrette served as chairman starting in 1974 and also had a stint as chief executive officer.

Going Public

In 1970, the firm sold shares to the public, allowing the founding partners to turn some of their equity into cash. Jenrette said becoming a public company was a goal of Donaldson since the firm's founding. It also ran counter to a New York Stock Exchange rule prohibiting members from going public.

"Big Board Defied by Member Firm," read the New York Times headline when DLJ announced its plan in 1969.

The NYSE could offer only limited resistance. Its leaders, "while appalled by DLJ's gambit," realized "that in order to continue financing the growth of the country's great businesses, Wall Street needed more capital," William D. Cohan wrote in a 2017 retrospective for Atlantic magazine. "The easiest and cheapest way for Wall Street to get the capital it needed was from the public, just as Wall Street's corporate clients had been doing for more than a century."

Other small Wall Street firms followed DLJ by going public in 1970, and a year later, they were joined by Merrill Lynch, Pierce, Fenner & Smith Inc., then the world's largest investment-banking firm. When Goldman Sachs Group Inc. sold shares in 1999, Wall Street's conversion to public ownership was largely complete.

Donaldson's Departure

At DLJ, Jenrette succeeded Donaldson as chairman in December 1973 when Donaldson went to work for Secretary of State Henry Kissinger in the administration of President Richard Nixon. Donaldson would later become chairman of the Securities and Exchange Commission.

In 1984, when DLJ was bought by Equitable Life Assurance Society, Jenrette was the sole original partner still at the firm. He rose to chairman and CEO of Equitable. When the insurer faced a financial crisis in 1990, Jenrette cut $150 million in annual costs, sold 49% of the company for $1 billion to AXA SA and raised $450 million in an initial public offering that was the biggest demutualization of a U.S. insurance company.