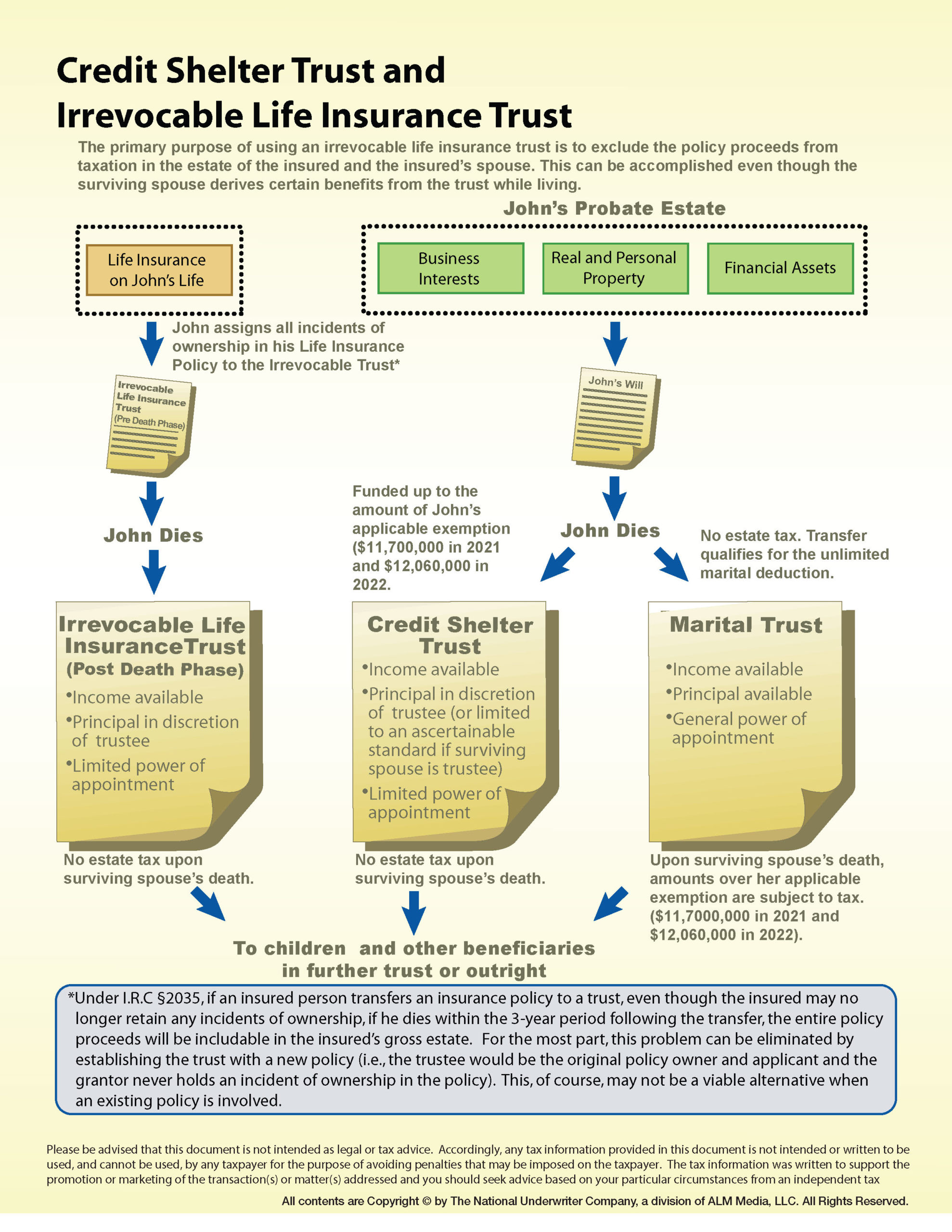

H—Credit Shelter Trust and Irrevocable Life Insurance Trust

The most effective way for the insured to divest himself of ownership of the life policy for estate tax purposes, but still assure that the policy and its proceeds, after his death, will be used in accordance with his desires and his financial plan, is to have the policy owned by an irrevocable trust. Through a trust, the insured can assure that his plan is carried out, by providing in the trust instrument how the policy and the proceeds upon death are to be dealt with. As long as neither the insured/grantor nor his estate is either directly or indirectly a beneficiary of the trust, and he does not retain elements of control (incidents of ownership) over the trust, he will not be deemed to own the policy for estate tax purposes.

Credit Shelter Trust and Irrevocable Life Insurance Trust PDFDownload

Cross References - Concepts Illustrated

Irrevocable Life Insurance Trust - Source of Estate Liquidity