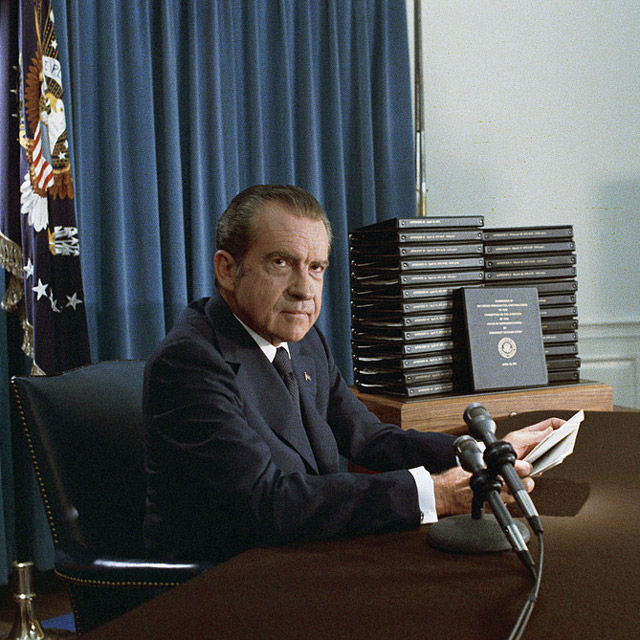

The S&P 500 is now poised for its worst first half since Richard Nixon's presidency.

With just seven trading days left until the end of June, the index is down 21% since the beginning of the year amid expectations that a toxic mix of high inflation and a hawkish Federal Reserve will tip the US economy into a recession.

The last time the S&P 500 had fallen this much during the first six months of any year was in 1970, according to data compiled by Bloomberg.

A 1970's-style inflation shock could send the index crashing about 33% from current levels to 2,525 amid stagnation with higher inflation, according to Societe Generale SA strategist Manish Kabra.