Page 25 - Investment Advisor June 2023

P. 25

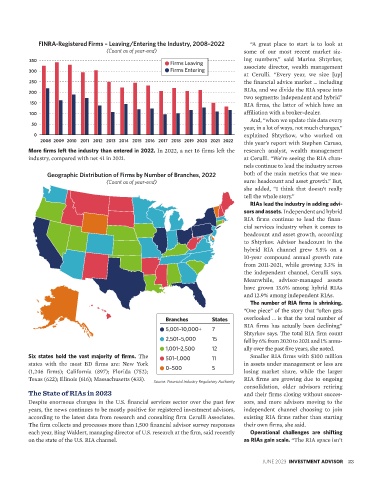

FINRA-Registered Firms – Leaving/Entering the Industry, 2008–2022 “A great place to start is to look at

(Count as of year-end) some of our most recent market siz-

350 ing numbers,” said Marina Shtyrkov,

Firms Leaving associate director, wealth management

300 Firms Entering

at Cerulli. “Every year, we size [up]

250 the financial advice market … including

RIAs, and we divide the RIA space into

200

two segments: independent and hybrid”

150 RIA firms, the latter of which have an

100 affiliation with a broker-dealer.

And, “when we update this data every

50

year, in a lot of ways, not much changes,”

0 explained Shtyrkow, who worked on

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 this year’s report with Stephen Caruso,

More firms left the industry than entered in 2022. In 2022, a net 16 firms left the research analyst, wealth management

industry, compared with net 41 in 2021. at Cerulli. “We’re seeing the RIA chan-

nels continue to lead the industry across

Geographic Distribution of Firms by Number of Branches, 2022 both of the main metrics that we mea-

(Count as of year-end) sure: headcount and asset growth.” But,

she added, “I think that doesn’t really

tell the whole story.”

rIAs lead the industry in adding advi-

sors and assets. Independent and hybrid

RIA firms continue to lead the finan-

cial services industry when it comes to

headcount and asset growth, according

to Shtyrkov. Advisor headcount in the

hybrid RIA channel grew 5.5% on a

10-year compound annual growth rate

from 2011-2021, while growing 3.3% in

the independent channel, Cerulli says.

Meanwhile, advisor-managed assets

have grown 13.6% among hybrid RIAs

and 12.9% among independent RIAs.

the number of rIA firms is shrinking.

“One piece” of the story that “often gets

Branches states overlooked … is that the total number of

5,001–10,000+ 7 RIA firms has actually been declining,”

Shtyrkov says. The total RIA firm count

2,501–5,000 15 fell by 6% from 2020 to 2021 and 1% annu-

1,001–2,500 12 ally over the past five years, she noted.

six states hold the vast majority of firms. The 501–1,000 11 Smaller RIA firms with $100 million

states with the most BD firms are: New York in assets under management or less are

(1,246 firms); California (897); Florida (752); 0–500 5 losing market share, while the larger

Texas (622); Illinois (616); Massachusetts (433). Source: Financial Industry Regulatory Authority RIA firms are growing due to ongoing

consolidation, older advisors retiring

The State of RIAs in 2023 and their firms closing without succes-

Despite enormous changes in the U.S. financial services sector over the past few sors, and more advisors moving to the

years, the news continues to be mostly positive for registered investment advisors, independent channel choosing to join

according to the latest data from research and consulting firm Cerulli Associates. existing RIA firms rather than starting

The firm collects and processes more than 1,500 financial advisor survey responses their own firms, she said.

each year, Bing Waldert, managing director of U.S. research at the firm, said recently operational challenges are shifting

on the state of the U.S. RIA channel. as rIAs gain scale. “The RIA space isn’t

June 2023 Investment AdvIsor 23