HSAs

HSA news and analysis, along with coverage of flexible spending arrangements, traditional health reimbursement arrangements, QSEHRAs, ICHRAs and new account types.

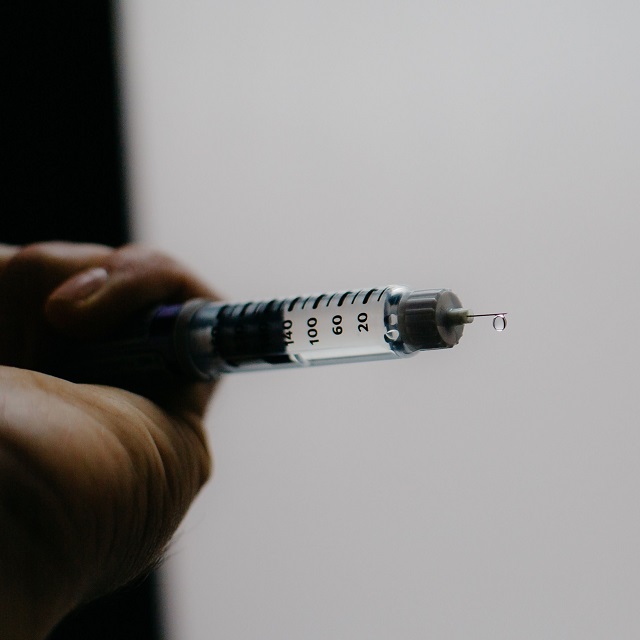

Budget Package Includes Insulin Help for HSA Users

By Allison BellSection 11408 would let HSA-compatible policies provide pre-deductible coverage for insulin.

May 16, 2022

How Much Will Health Care Cost in Retirement? Most Americans Have No Idea, Fidelity FindsFidelity's annual study found widespread misconceptions about Medicare, HSAs and how much retirees can expect to pay for care.

May 11, 2022

How to Supercharge an HSA With an IRA RolloverAn IRA-to-HSA rollover can be a tax-preferred way to cover a large medical expense, but the rules are detailed.

April 28, 2022

HealthCare.gov Notices New Class of Individual Employer PoliciesCMS plans to add an ICHRA data stream in 2025.

April 26, 2022

Medicare HSA Bill ReturnsH.R. 7435, introduced by Reps. Ami Bera and Jason Smith, would let Medicare enrollees contribute to health savings accounts.

April 01, 2022

House Passes Insulin Cost-Sharing BillH.R. 6833, the Affordable Insulin Now bill, would cap an insured patient's copay at $35 per month.

March 30, 2022

Biden Hopes to Tax Some Indemnity Health BenefitsGross income could include the gap between a medical expense and the benefit payment amount.

March 24, 2022

5 Republican Senator Ideas for Supporting Home CareLawmakers discussed beefing up Medicaid home care benefits and caregiver pay at a Senate Special Committee hearing.