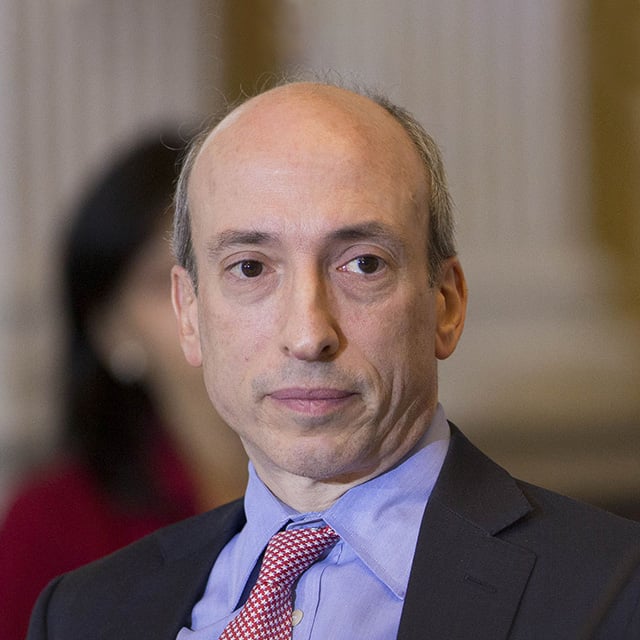

The Securities and Exchange Commission would use its 2024 budget boost in a Senate appropriations bill to add 83 additional full-time examiners, SEC Chairman Gary Gensler told senators Wednesday.

The Appropriations Committee appropriated $2.4 billion to the SEC, $194 million more than the fiscal year 2023 enacted level and close to $73 million less than the budget request. That cut back on the agency's ability to add about 170 additional positions, Gensler said.

The agency's fiscal 2024 request would help the SEC Examinations Division grow to 1,144 full-time examiners, "allowing it to keep pace with the market challenges of the last decade," Gensler told the senators during a Senate Appropriations Financial Services and General Government hearing, held Wednesday.

"The majority of this increase relates to full-year funding for those staff positions authorized and hired in FY 2023," Gensler told the senators.

The "SEC is 3% larger than it was in 2017," he said.

Meanwhile, from 2017 through 2022, "the number of clients of registered investment advisers grew nearly 70% from 34 million to 57 million," he said. "During that same period, average daily trading in the equity markets more than doubled from more than 30 million transactions to more than 77 million."

He pointed out that "such growth and rapid change also mean more possibility for wrongdoing. As the cop on the beat, we must be able to meet the match of bad actors. Thus, it makes sense for the SEC to grow along with the expansion and increased complexity in the capital markets."

Chart: SEC

Chart: SEC

In FY 2022, the SEC conducted more than 3,000 exams across the agency's "tens of thousands of registrants, from investment advisers to broker-dealers to exchanges," Gensler said.