A veteran advisor and broker who jumped with her $1.1 billion group from Merrill Lynch to J.P. Morgan in October 2020 has sued her current firm, alleging its Private Bank division has been aggressively trying to steal her clients.

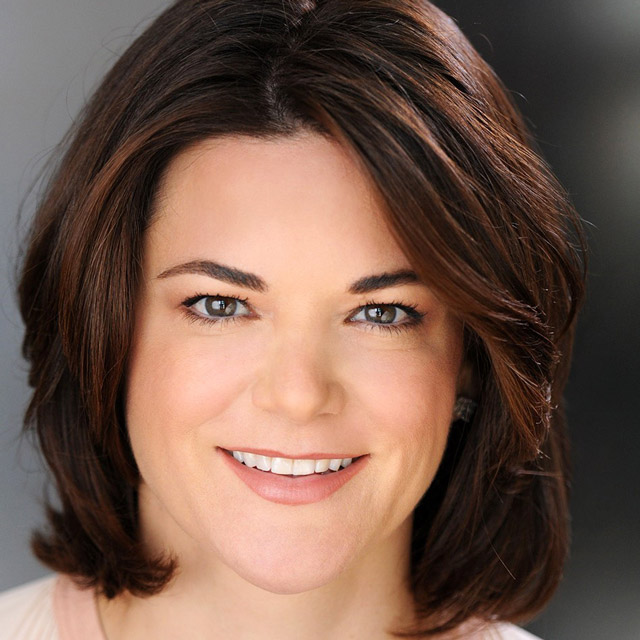

In a complaint filed Thursday in U.S. District Court for the Northern District of California in San Francisco, Gwen Campbell, managing director of The Campbell Group at J.P. Morgan Wealth Management, said her action arises from "ongoing efforts by J.P. Morgan Private Bank … to poach" her relationships with her advisory clients after she moved from Merrill.

"After J.P. Morgan aggressively recruited Campbell and persuaded her to move her clients with explicit contractual promises they would not be poached by other groups at the bank, the Private Bank began ruthlessly soliciting her clients, disparaging her, and preventing clients from sending assets to Campbell (and redirecting them to the Private Bank) without her consent," the complaint alleged.

And it has only gotten worse, according to the complaint. "In recent weeks, the Private Bank has significantly escalated its attacks on Campbell's client relationships and thwarted her ability to execute client transactions while, after months of promising to make things right, Campbell's superiors at J.P. Morgan have conceded that they are powerless to help," the complaint alleged.

Due to the "misrepresentations and breaches" by J.P. Morgan, Campbell is "suffering irreparable harm to her business, her reputation, and the client goodwill that has taken her decades to build," the complaint alleged.