An SEC commissioner appointed by former President Donald Trump has warned life insurers against assuming that they will be able to pay sales commissions to sellers of variable annuities.

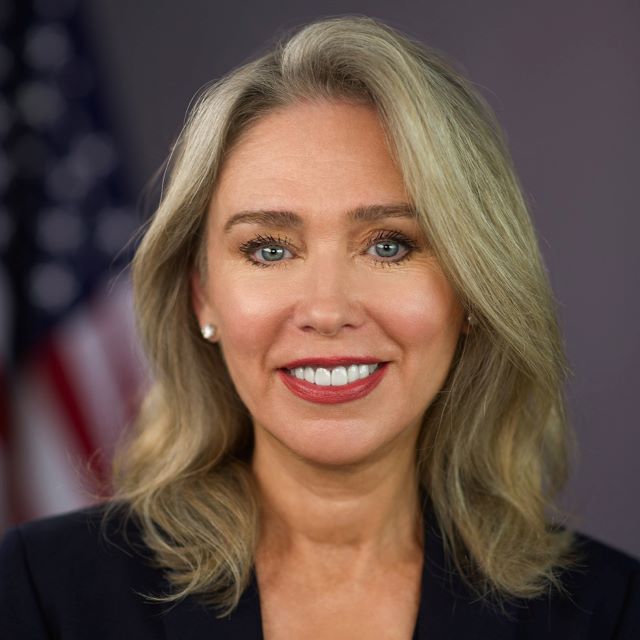

Allison Herren Lee told life insurance company lawyers recently that variable annuity issuers will have to comply with the SEC's Regulation Best Interest, not just state annuity suitability rules.

State suitability rules based on the new National Association of Insurance Commissioners model simply require issuers to disclose producer compensation arrangements that could lead to conflicts of interest, not to mitigate those conflicts, Lee said, according to a written version of her remarks.

"Under Reg BI, which applies to the entire range of securities and includes variable insurance products, the commission came to a different conclusion about the need for and benefits of mitigation," Lee said. "As states continue to adopt and implement the NAIC model, I encourage those of you in the securities and insurance industries to evaluate your policies and procedures, to ensure they are consistent with both standards."

Lee spoke at a life insurance company products conference organized by the American Law Institute.

An SEC-Industry Dialog

The conference also included sessions on many other topics, including regulation of registered index-linked annuities.

RILAs are increasingly popular products that are registered as securities, and expose the holder to some risk of loss of contract value, but that tie the crediting rate to the performance of bonds and derivatives held in the issuers' own general account investment portfolios, rather than to the performance of assets in the annuity holders' separate accounts.

Lee noted that there was a dialog between the SEC and the insurance industry that can help both the SEC and the insurers serve investors better.