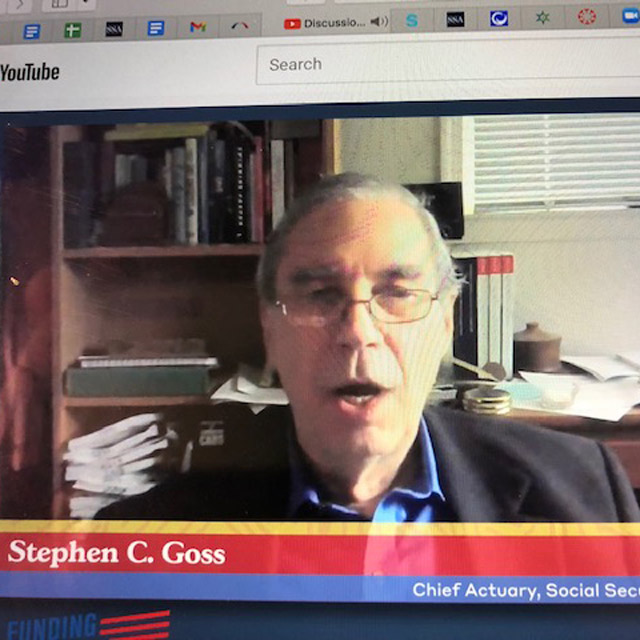

As announced Wednesday by the Social Security Administration, beneficiaries will receive a cost-of-living adjustment of 5.9% in 2022. However, also announced, said Stephen Goss, SSA chief actuary, during a panel discussion held by the Bipartisan Policy Center directly after the announcement, was the average wage index or AWI, "which is just as important [as the COLA] to many, many people," as it affects how benefits are calculated at retirement age.

And while the COLA will be the biggest in 40 years, don't expect big annual raises to become a trend, the policy experts say.

A Bipartisan Policy Center webinar on Wednesday featured a broad discussion of the COLA and other retirement numbers, along with what retirees can expect for future increases as well as whether the current index used to calculate COLAs best fits retirees' needs.

Although the panel — made up of Goss, Chantel Boyens of the Urban Institute and moderator Jason Fichtner, BPC's chief economist and vice president, focused mainly on the inflationary issues surrounding the COLA, Goss made clear the AWI, which is based on actual 2020 W-2 forms from all U.S. wage earners, increased 2.8% from a year earlier.

"That's significant because individuals becoming newly eligible for benefits in 2022 will have their benefit formula adjusted by the average wage index," Goss said, adding that a year or so ago before the pandemic took hold, many didn't expect the AWI to rise.

Although many factors are affected by this increase, he said, one is the taxable maximum dollar amount that will be adjusted, up to $147,000.

He also noted that prior to the pandemic and ensuing recession, when the Social Security trustees were working on their 2020 report, they were expecting an AWI increase of 3.5%. However, "we actually ended up having 2% fewer workers who worked at any point during the year for a day, but 2.7% less aggregate wages during the year."

COLA Debate

The discussion also addressed how the COLA is calculated, using the CPI-U, or the Consumer Price Index for Urban Wage Earners, and how that calculation could be changed.

Some proposals include using the CPI-E, which weighs more heavily costs most often incurred by the elderly, such as health care, or the chained CPI, which considers changes to consumer spending patterns to provide a more accurate picture of the cost of living based on the goods that consumers actually buy.

Although Boyens noted that the CPI-E is an "experimental" index, Goss disagreed, stating the share of people in the SSA survey age 62 and over "is at least, if not larger than the share of the urban wage earners or clerical workers. So the BLS dropped the 'experimental' notation on that."