Michel Khalaf (Photo: S&P Global Ratings)

Michel Khalaf (Photo: S&P Global Ratings)

Life insurance company executives spent some time Wednesday talking to S&P Global Ratings Insurance Conference attendees about the effects of low bond yields on their companies' plans for the future.

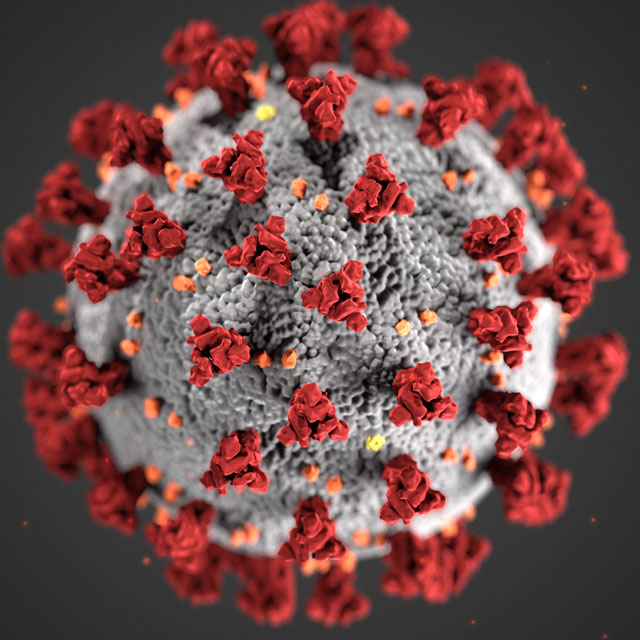

But what the executives spoke about with the most passion is the role their companies played in helping hundreds of thousands of families in the United States, and many more families in the rest of the world, cope with the effects of the COVID-19 pandemic on morbidity and mortality.

S&P provides financial stability ratings that help determine whether companies can borrow money, by issuing bonds or other debt securities, and how much interest the borrowers pay on their debt.

S&P also provides ratings that indicate how well-equipped insurers are to meet insurance obligations. Those ratings influence what kinds of products insurers can write and what insurers can charge for the coverage.

Because of S&P's central place in the financial system, its insurance conference attracts money managers, regulators and other high-powered insurance industry watchers from all over the world.

S&P held this year's insurance conference on the web, rather than in-person, because of the ongoing effects of the COVID-19 pandemic on travel.

The Numbers

The World Health Organization reported that, as of earlier today, public health agencies from around the world had recorded 3.8 million COVID-19-related deaths.

Dean Connor, the CEO of Sun Life Financial Inc., cited an analysis suggesting that the true COVID-19 death toll might be as high as 10 million.

"That's an astonishing number," Connor said, during a conference panel discussion featuring life insurance company CEOs. "That is a shockingly large number."

In a normal year, Connor said, about 55 million people die from all causes.

But, in an instant poll, S&P conference attendees rated pandemic-related mortality relatively low on their list of concerns.

That's because the life insurance industry has managed mortality risk well, Connor said. "We've got the right reinsurance, and the right risk-sharing designs. I don't think, frankly, that it will have a huge pricing impact. I see this more as a shock event, as opposed to a persistent event."

Life Insurers' Purpose

Michel Khalaf, who took over as the CEO of MetLife Inc. in 2019, said, during the CEO panel, that life insurers' mission is to step in to repair the financial damage resulting from life's most tragic and destabilizing events.

"COVID-19 is what life insurers are made for," Khalaf said. "I've heard some say that, during the pandemic, there was no place for companies to hide. They either lived their purpose, in the way that they showed up for their people, for their customers, or they didn't… I think clarity of purpose is particularly important when you're dealing with a situation where there is no road map or playbook in terms of how to manage."

Life insurers and rating agencies may talk, in general, about the the effects of elevated life claims on an insurer's finances, but, at the core, Khalaf said, "every one of these claims represents a family or beneficiary that needed assistance during the crisis."

Khalaf said life insurers played an important role in promoting stability, by meeting obligations to policyholders and beneficiaries.

MetLife also took aggressive steps to support and communicate with its own employees and associates, Khalaf said.

Some critics reacted to the 2000 dot-com market meltdown and the 2007-2009 Great Recession by wondering how well life insurers would really do in a crisis.

MetLife and other life insurers have done well during the COVID-19 pandemic, and that's a testament to the improvements life insurers have made in balance sheets and risk management practices in recent years, Khalaf said.