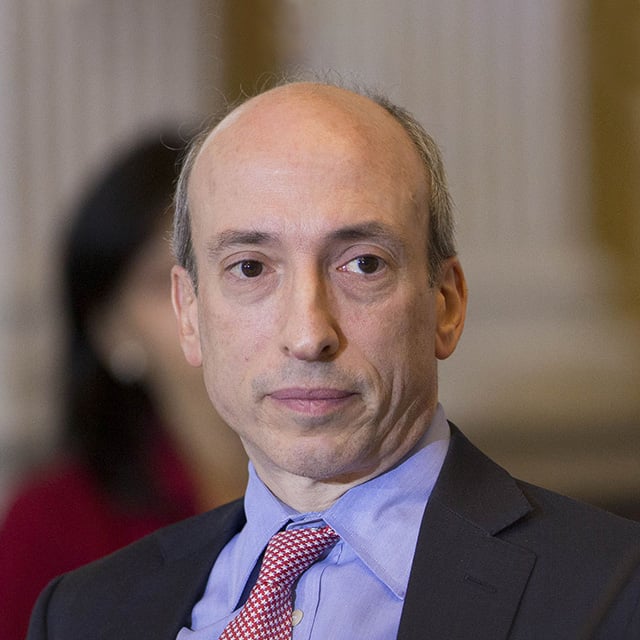

Securities and Exchange Commission Chairman Gary Gensler said Thursday that while the agency plans to "vigorously get the most" out of Regulation Best Interest, the agency will "constantly evaluate" how the rule is serving investors and it could be modified.

During a question-and-answer session at a hearing held by the House Financial Services Committee on the run-up in GameStop shares earlier this year, Rep. Ann Wagner, R-Mo., queried Gensler on whether he planned to make "any amendments to Reg BI."

Gensler responded: "I think that it's important that investors actually have brokers take their best interests at heart, and that's what we're going to do through examination and enforcement, guidance ensure that that rule is fully complied with as written."

Later in the hearing, Gensler stated that "we're going to vigorously get the most out of Regulation Best Interest, but we're also going to evaluate. If it's not serving the purpose of investors then we will update and freshen that rule as well as other rules because we always have to be evaluating that investors come first, aligned with our three-part mission."

Gensler also told lawmakers during the hearing titled, Game Stopped? Who Wins and Loses When Short Sellers, Social Media, and Retail Investors Collide, Part III, that SEC staff "is vigorously reviewing for any violations" the market volatility witnessed in January during the Reddit GameStop short squeeze and that he's directed staff to consider whether "expanded enforcement mechanisms" are necessary.

The securities regulator, Gensler told lawmakers, plans to release this summer a report on the market volatility spurred by the Reddit GameStop incident.

Said Gensler: "We've all come to hear the general story: a stock that went from $20 to $480 and back down to $40, all in a matter of weeks. It opened at $162 Wednesday of this week. GameStop, though, was just one of the many so-called meme stocks that exhibited significant price volatility, trading volume, and attention in the markets in January. As these events reached an apex in late January, a number of broker-dealers imposed trading restrictions on some of these stocks."

He added, "While entities such as GameStop, Melvin Capital, Reddit and Robinhood have garnered a significant amount of attention, the policy issues raised by this winter's volatility go beyond those companies. Instead, I think these events are part of a larger story about the intersection of finance and technology."