(Credit: MIB)

(Credit: MIB)

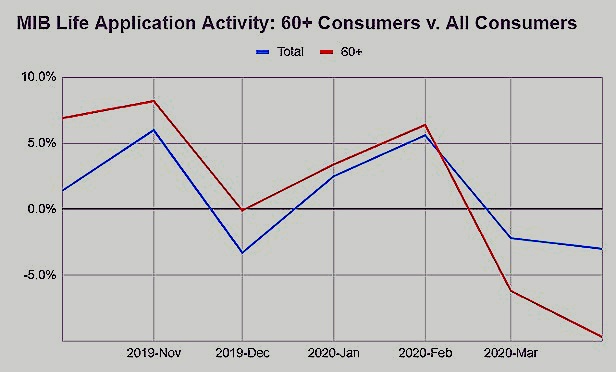

MIB Group Inc. has numbers suggesting that the COVID-19 shelter-in-place rules, and pandemic-related underwriting shifts, were tougher on older consumers than on younger consumers.

U.S. life insurance application activity fell a little for young consumers in April, more for middle-aged consumers, and a lot for older consumers, according to MIB's new application activity report.

The Braintree, Massachusetts-based group says overall application activity was 3% lower last month than in April 2019.

Here are the MIB activity numbers for each age group for April:

- Ages 0-44: -0.7%

- Ages 45-59: -2.4%

- Ages 60 and older: -9.7%

MIB is a nonprofit industry group that helps life insurers share some of the information used in the underwriting process.

Resources

- A copy of the latest MIB life application activity report is available here.

- An article about the MIB life application activity figures for March is available here.

The application activity figures reflect trends in use of MIB databases.

In mid-March, many cities, and some states, responded to the COVID-19 pandemic by imposing shelter-in-place rules. The typical shelter-in-place program required workers at establishments classified as "non-essential" to work at home.