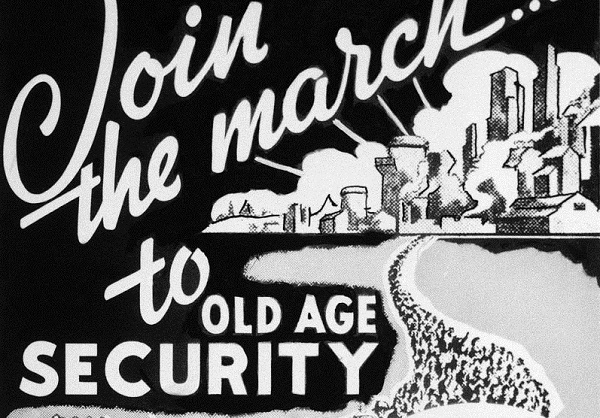

A 1936 poster issued by the Social Security Board to promote the application for Social Security cards for Americans. (AP Photo)

A 1936 poster issued by the Social Security Board to promote the application for Social Security cards for Americans. (AP Photo)

Although the deficit in the Social Security program is expected to increase even prior to the coronavirus pandemic, a new report from the Center for Retirement Research at Boston College points out that the program's financing shortfall over the next 75 years is "manageable" and, once the pandemic has been dealt with, can—and should—be addressed to allow it to continue to pay full promised benefits to retirees.

Fewer Babies, Reduced Payroll Taxes, Low Inflation and Interest Rates

Four factors weigh on the 75-year deficit, which has increased from 2.78 percent to 3.21 percent of taxable payroll. Those factors are the following:

- repeal of the tax on high premium health plans, resulting in lower earnings and payroll taxes

- a lower assumed total fertility rate

- lower inflation, which reduces earnings and payroll taxes before it hits benefits

- and a lower interest rate, which means less discounting of large future deficits.

Between a lower fertility rate, which cuts the number of future participants in the program, and a wave of retiring boomers, the ratio of workers to retirees has fallen from about 3:1 to 2:1; that has raised costs accordingly. When the effect of longer lifespans is added in—meaning that retirees collect benefits for a longer period of time—there is a problem along the road ahead.

In addition, the Great Recession took a toll on the Social Security trust fund, which had been expected not to be needed to help pay benefits until several years later than happened in actuality. Currently what's being drawn on is the interest on the trust fund; but since payroll taxes are presently inadequate to cover all the legislated benefits they are intended to cover, that means the program will have to start drawing on the principal in the trust fund.

However, says the report, not only does the trust fund depletion date remain at 2035, payroll taxes will still be able to cover approximately 79 percent of promised benefits. And the coronavirus is unlikely "to fundamentally alter the long-term financial status of the program."