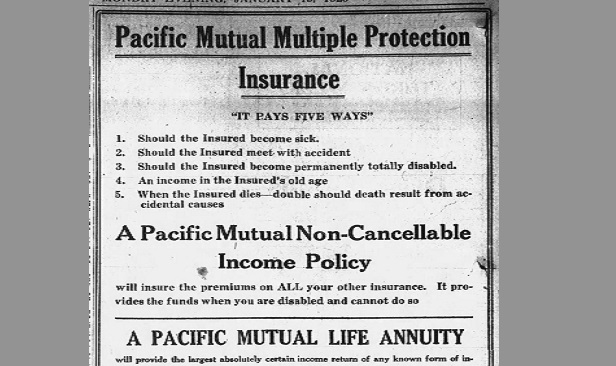

A Pacific Life annuity ad that ran in the Jan. 1, 1920, issue of the Wilkes-Barre (Pa.) Times Leader.

A Pacific Life annuity ad that ran in the Jan. 1, 1920, issue of the Wilkes-Barre (Pa.) Times Leader.

Financial services organizations have been providing annuities since the Egyptian pyramids since the pyramids had that new pyramid smell.

U.S. life insurers have been telling consumers about all of the things annuities can do from the beginning. On New Year's Day 100 years ago, for example, Pacific Life was advertising that an annuity can help insure a purchaser's ability to pay for all of the purchaser's other forms of insurance.

The U.S. annuity market has become a huge market.

But the mutual fund still has the glamor, even though mutual fund managers can't offer any guarantees.

Investment advisors, and even employee benefits advisors who come out of the property and casualty insurance sector, seem to be more visible in the retirement plan market than life and annuity agents — even though life insurers helped make retirement planning thing.

One big question for the annuity market for 2020 is this: After all of that time and money life insurers and agent groups put into supporting the "Setting Every Community Up for Retirement Enhancement Act of 2019″ (Secure Act) bill, will the new Secure Act law create opportunities for retail life and annuity producers to get back into the small retirement plan game?

The Secure Act is part of the new Further Consolidated Appropriations Act of 2019 law. It provides two tax credits that can provide up to $16,500 in subsidy support over three years for new retirement plans. It will also give financial services companies a way to create multiple employer retirement plans.

Will any of this be good for you?

Here are four other new questions that could shape our annuity coverage in the coming year.

1. Will interest rates be helpful?

Most annuity issuers would probably benefit if interest rates started rising again.

2. Will the Financial Accounting Standards Board actually implement any tough new accounting rules?

Or, is it possible that we're usually better off not knowing what kinds of scary things are happening to the true current market value of life insures' investments and liabilities?

3. Will deferred income annuities find loving homes?

The idea of paying a small amount for a lifetime stream of income that starts at age 85, or 95, sounds like a great, cheap way to cope with the fact that most of us are wretched at saving for retirement.

Why is it that the U.S. DIA market still looks like a pipsqueak?

4. Are any of the web-based annuity brokers selling many annuities?