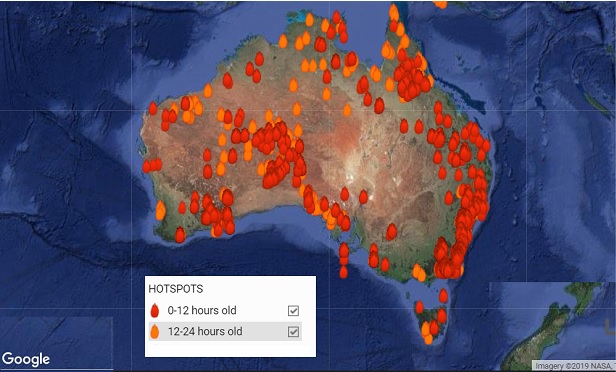

A map created by the government of Western Australia, using Landgate systems, shows that fires are burning, or have been burning in the past 24 hours, up and down Australia's east coast. (Credit: the Western Australian Government)

A map created by the government of Western Australia, using Landgate systems, shows that fires are burning, or have been burning in the past 24 hours, up and down Australia's east coast. (Credit: the Western Australian Government)

The wave of bushfires now roaring over much of Australia has raised a sensitive question: Are the fires relevant enough to people interested in the U.S. life insurance and annuity markets that those people can justify reading about the fires while at work?

The answer appears to be that the bushfires in Australia will have little effect on U.S. life insurers' real estate, mortgage or mortgage-backed securities' portfolios, but that concerns about the fires might affect how U.S. life insurers see their investments in real estate-related assets in the United States.

Australia Basics

Australia has 26 million residents living in an area of 3 million square miles.

Fires began burning there months ago. The fires getting the most attention in Australia now, which are in the Australian states of Victoria and New South Wales, are affecting about 14 million.

The number of people affected by the fires in Australia is similar to the size of the population of Pennsylvania.

Two years ago, when a wave of wildfires was burning through California, those fires were affecting about 11 million people.

Australia has residential real estate with a total value of about $5 trillion, in U.S. currency, and commercial real estate with a total value of about $600 billion.

Australia's Insurance Council of Australia has received reports of only about $200 million in bushfire-related property insurance claims as of Dec. 20, but the fires appear to have expanded, and come closer to the edges of big cities, such as Melbourne and Sydney since then.

Today, for example, Twitter is full of notices from Australia's fire safety authorities. The authorities are telling many people that their communities are surrounded by fire, and that there's no way for the people living in those communities to evacuate. Those people are being advised to try to find shelter on the beach, or in a lake. People on Twitter are posting many accounts of hearing of firefighters who have run out of water and have had to give up on trying to save homes.

U.S. Life Insurers' Investments

U.S. life insurers ended 2018 with about $4.2 trillion in assets, $523 billion in investments in mortgages, and about $20 billion in investments in real estate, according to the National Association of Insurance Commissioners' Capital Markets Bureau.