An excerpt from an LTCI policyholder's comment on proposed rate increases in Virginia. (Image: Virginia Bureau of Insurance)

An excerpt from an LTCI policyholder's comment on proposed rate increases in Virginia. (Image: Virginia Bureau of Insurance)

One of the quirks of the market for stand-alone long-term care insurance (LTCI) is that LTCI hold on to their policies with an iron grip, even when the issuers impose big rate increases.

LTCI policy persistency rates have been much higher than insurers assumed when they set the rates for the prices sold before 2000.

In some cases, LTCI issuers have implemented big rate increases without getting much public attention for the increases, let alone big spikes in policy lapse rates.

In Virginia, however, the Virginia Bureau of Insurance has received more than 60 responses to a request for public comments about LTCI rates.

The bureau has received nine separate LTCI rate change requests so far this year, for blocks of policies ranging in size from 45 policies to 8,645 policies. The minimum rate changes requested in the nine filings would actually be a decrease of 30% to 40%, but the average changes requested would be increases of 25% to 105%.

The comments were due April 22. The bureau plans to hold a public hearing on LTCI premiums at 10 a.m. May 21 at its offices, in Richmond, Virginia.

Most of the commenters appear to be ordinary state residents with little knowledge of how LTCI and LTCI rate reviews work. In some cases, they ask for responses to the rate increase requests that are already common in Virginia or in other states. But the comment letters may show a little of what might be in the backs of regulators' minds as they're reviewing the rate change applications.

Here are seven things people are saying in the comment letters.

1. The real problem is the underlying cost of care.

Robert Whittaker, a resident of Providence Forge, Virginia, wrote to say that he believes an LTCI rate increase request for, for example, 339.6% is understandable, given how high the cost of nursing home care is.

"Not that I want to have to pay it, but they [insurers] have little or no way of controlling the never ending rising cost any more than I do from the health care providers," Whittaker writes.

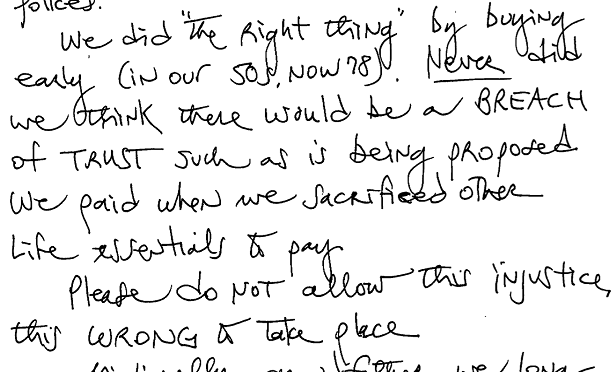

2. 'Please do not allow this injustice.'

Many more commenters have written to say simply that letting insurers impose large LTCI rate increases is wrong.

Aileen Weber, a resident of Williamsburg, Virginia, writes that she and her husband are now 78 and bought their LTCI coverage when they were in their 50s.

"Never did we think there would be a BREACH of TRUST such as is being proposed," Weber writes.

3. The rising cost of long-term care services shouldn't matter.

Charles Ford of Virginia Beach writes that the argument that LTCI premiums are rising because of the rising cost of long-term care services is absurd.