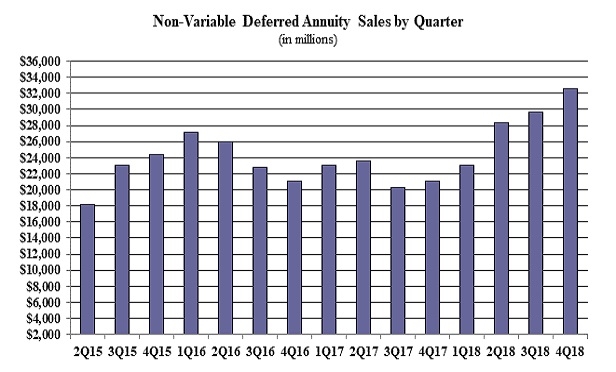

Low interest rates, competition from booming stock prices, and concerns about the U.S. Department of Labor's first big fiduciary rule project held down annuity sales in 2016 and 2017. Sales began to recover in 2017, as policymakers in Washington began to pull away from the Obama-era fiduciary rule effort.

In the latest quarter, sales growth for MYGA contracts was especially strong.

Here's what happened to sales of the three types of annuities Wink includes in the non-variable annuity data:

- Indexed annuities: Up by 41%.

- Traditional fixed annuities: Up by 57%.

- Multi-year guaranteed annuity (MYGA) contracts: Up by 81%.

Wink has also started collecting sales data from issuers of structured annuities.

A structured annuity is an annuity contract, filed as a variable annuity contract, that lets the holder benefit from an increase in an investment index, or collection of investment indexes, while giving the holder a limited amount of protection against a drop in the investment index, or collection of indexes.

Wink says the 10 structured annuity issuers participating in its survey program reported $4.1 billion in structured annuity sales for the fourth quarter, and about $12 billion in structured annuity sales for all of 2018.

Resources

A summary of Wink's latest annuity issuer survey results is available here.

(Image: Wink Inc.)

(Image: Wink Inc.)