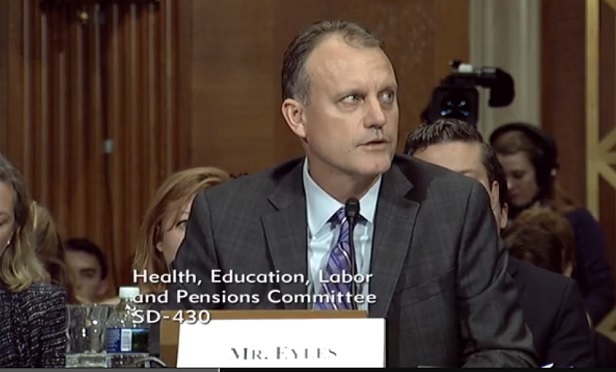

Matt Eyles of AHIP testifies at a Senate health cost hearing. (Photo: Senate HELP)

Matt Eyles of AHIP testifies at a Senate health cost hearing. (Photo: Senate HELP)

If Congress really wants to do something about high U.S. health care administrative costs, one place it could look might be the federal government's own Affordable Care Act public exchange plan system.

Matt Eyles, the president of America's Health Insurance Plans, and Robert Book, an economist, talked about ACA exchange system administrative costs earlier this week, at a hearing on health care administrative costs.

The Senate Committee on Health, Education, Labor and Pensions organized the hearing to come up with ideas about ways to reduce U.S. health care administrative spending.

"Administrative costs are much higher in the U.S. than in other countries," Sen. Lamar Alexander, R-Tenn, the committee chairman, said at the hearing.

Administrative Cost Villains

Alexander cited a researcher's estimate that administrative costs account for about 8%, or $264 billion, of U.S. health care spending each year, compared with an average of 1% to 3% in other countries.

Alexander cited implementation of Medicaid and Medicare physician office electronic health record system requirements as an example of well-intended but poorly organized federal bureaucracy driving up administrative costs.

Sen. Patty Murray, D-Wash., said the Trump administration's move to let insurers keep short-term medical insurance coverage in place for up to 36 months, rather than just 3 months, could drive up administrative costs, because short-term medical issuers are exempt from the ACA minimum medical loss ratio (MLR) provision, which requires that major medical coverage providers spend at least 85% of large group revenue, and 80% of individual or small group revenue, on health care and quality improvement efforts.

One analysis found that short-term medical issuers spend about half of their revenue on items unrelated to the cost of patient care, Murray said.

ACA Exchange System Costs

Five years ago, policymakers were hoping the ACA public exchange system could mobilize consumers to help hold coverage costs, by giving consumers a simple, web-based system they could use to compare health plans on an apples-to-apples basis.

One thought was that access to web-based health insurance supermarkets would cut overall sales, distribution and marketing costs. Another was that consumers would push health insurers to minimize all costs, including administrative costs, while maximizing quality.

The ACA exchange system came to life in October 2013, with the first coverage sold taking effect Jan. 1, 2014.

Book, a health care economist who serves as an advisor to Douglas Holtz-Eakin's American Action Forum, testified that he believes, based on government figures, that the birth of the exchange system increased average administrative costs per individual major medical enrollee to $893 in 2014, from $414 in 2013.