A longtime long-term care insurance (LTCI) distributor has succeeded at converting a pool of LTCI commission receivables into cash.

LTC Global Inc. worked through KeyBanc Capital Markets Inc. to create securities backed by the commission receivables. KeyBanc then helped LTC Global sell the securities to seven institutional investors.

Winston & Strawn LLP, a law firm, served as the securitization legal advisor.

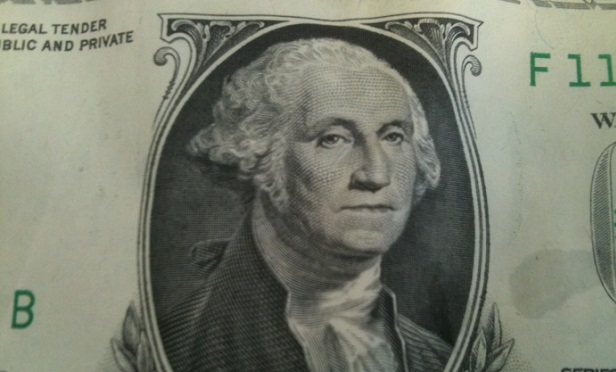

The deal had a value of $129.6 million, according to LTC Global.

(Related: What to Say Now About LTCI Rate Increases)

LTC Global is a Fort Myers, Florida-based company that distributes life insurance, health insurance and LTCI coverage. The company also provides financing for agents through a commission advance program and a renewal commission purchase program.

Daniel Schmedlen Jr. chief executive officer of LTC Global, said in a statement that the deal will help the company expand its operations.

"This transaction is the first of its kind and represents a tremendous effort by our company, especially our finance and actuarial groups," Schmedlen said.