(Graphic: Claude Thau)

(Graphic: Claude Thau)

Most of us were advised in elementary school to communicate in such a way that we can be understood. It is better to communicate in ways that canNOT be MISunderstood.

Obviously, perfection is unattainable, but reviewing messaging to remove possible confusion usually produces greater comprehension. Authors know what they intend to say, hence are prone to miss potential ambiguity. To ferret out possible confusion, it is essential that a variety of reviewers with different experience "scrub" important communication such as rate increase letters.

It is also important to provide excellent counseling when difficult decisions (as will be demonstrated below) need to be made.

With the many rate increases in the LTCI industry, you might think that we've got the communication down pat, but I saw two letters and a comparison recently that stimulated this article.

"Your premium is not being increased"

The above wording was the beginning of the second sentence of a rate increase letter. The full first two sentences read as follows:

"After a careful review, we have found that a premium increase is necessary to continue providing your long term care coverage. Your premium is not being increased due to changes in your personal health, age or claims history."

I admit that if clients read both sentences completely, they should understand. But they may be confused and stop reading. There are many simple ways to improve the second sentence. For example:

"Your premium increase is not related to your personal health, age or claims history."

Or:

"The premium increase is the same for all policies like your policy in your state. It does not vary based on any individual's personal claims, health status, or age."

I'm not pushing any particular wording. My point is simply that a rate increase letter should not say, "Your premium is not being increased…"

What happens to the second part of the rate increase?

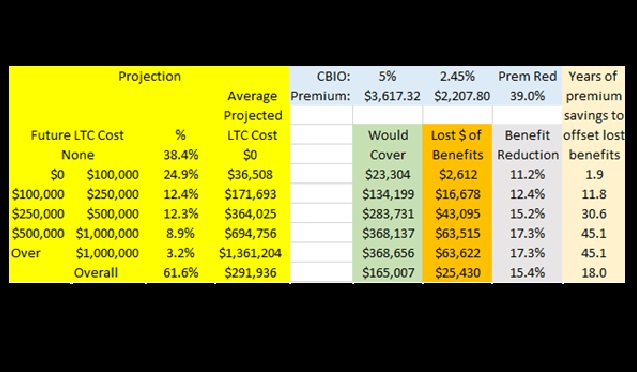

An 84-year-old client forwarded a letter explaining that her policy was scheduled to have two consecutive 28% rate increases. The letter quoted three alternatives other than accepting the full increase: a landing spot (reducing her future compounding to 2.45%) to maintain her previous premium and options to avoid part of the increase by lengthening her elimination period or shortening her benefit period.

The letter did not indicate what would happen to the second 28% increase if an alternative was selected.

So I emailed the actuary who signed the rate increase filing, guessing that each option replaced both 28% increases. The actuary responded promptly, indicating that he'd research my question.

As I considered my client's options more fully, I decided that probably each alternative dealt solely with the first 28% increase, resulting in a future 28% increase regardless of which option she selected. I did not want the actuary to think that I was trying to corner him, so I wrote a second message indicating my revised impression.

It turned out that neither of my theories was true!

- If she lengthened your elimination period or shortened her benefit period, she would subsequently receive a second increase (28% of her then-current premium).

- If she lowered her future compounding to 2.45%, she would avoid both 28% increases.

How could she make an intelligent choice based on the information in the rate increase letter? With quality review of the letter prior to usage, I would expect someone to have exposed this problem. It would be easy for the letter to state, for each option, what the premium will be after the second stage of the increase.

Are insurers caught between a rock and a hard place?

Generally, actuaries make a certification similar to the following to the insurance department: "If the requested increase is implemented and the underlying assumptions are realized, no further premium rate schedule increases are anticipated. However, going forward, the Company will continue to monitor the experience of this block and reserves the right to take additional rate action if currently unanticipated future deterioration thereof justifies."

However, if insurers suggest that premiums will remain level in the future, then encounter a situation which spurs an additional premium increase, they fear being subject to lawsuits.

Thus, despite the wording in the actuarial certification, the letter to the policyholder may say something like: "It is likely that your premium will increase again in the future."

Unfortunately, the more an insurer indicates that future price increases are likely, the more likely that a client will drop coverage or elect a benefit reduction because he/she does not expect to be able to afford future rate increases. Clients fearing (a possibly never-ending) series of rate increases may sacrifice coverage unnecessarily.

The following wording may avoid unduly scaring the client, while not creating exposure to a lawsuit. Again, I'm just showing an alternative, not pushing particular wording.

"If our current assumptions are realized, no further premium increases would be necessary. However, the Company reserves the right to increase prices further if unanticipated deterioration occurs."