Americans may not be saving enough for retirement, according to multiple analyses, but an increasing number are participating in work-based retirement savings plans and those assets growing, especially in IRAs, the Employee Benefit Research Institute reports.

Its latest analysis of individual retirement plans, based on 2016 data, EBRI says more than 79.4% of family heads eligible to participate in a defined contribution (DC) plan at work did so, up from 78.7% three years earlier. The percentage of families owning IRAs or Keogh plans rose to just under 30% from 28.1% in 2013. In both cases participation was greatest among families who had higher incomes and had achieved higher levels of education.

Average account holdings were just under $168,000 among families with DC plans, up almost 25% from 2013, and were just under $204,000 in IRA/Keogh plans, up just 2% from 2013.

Median account balances, however, were a different story: $43,000 for DC plans, up 13% from 2013, and $53,000 for IRA/Keogh plans, up 3% from 2013.

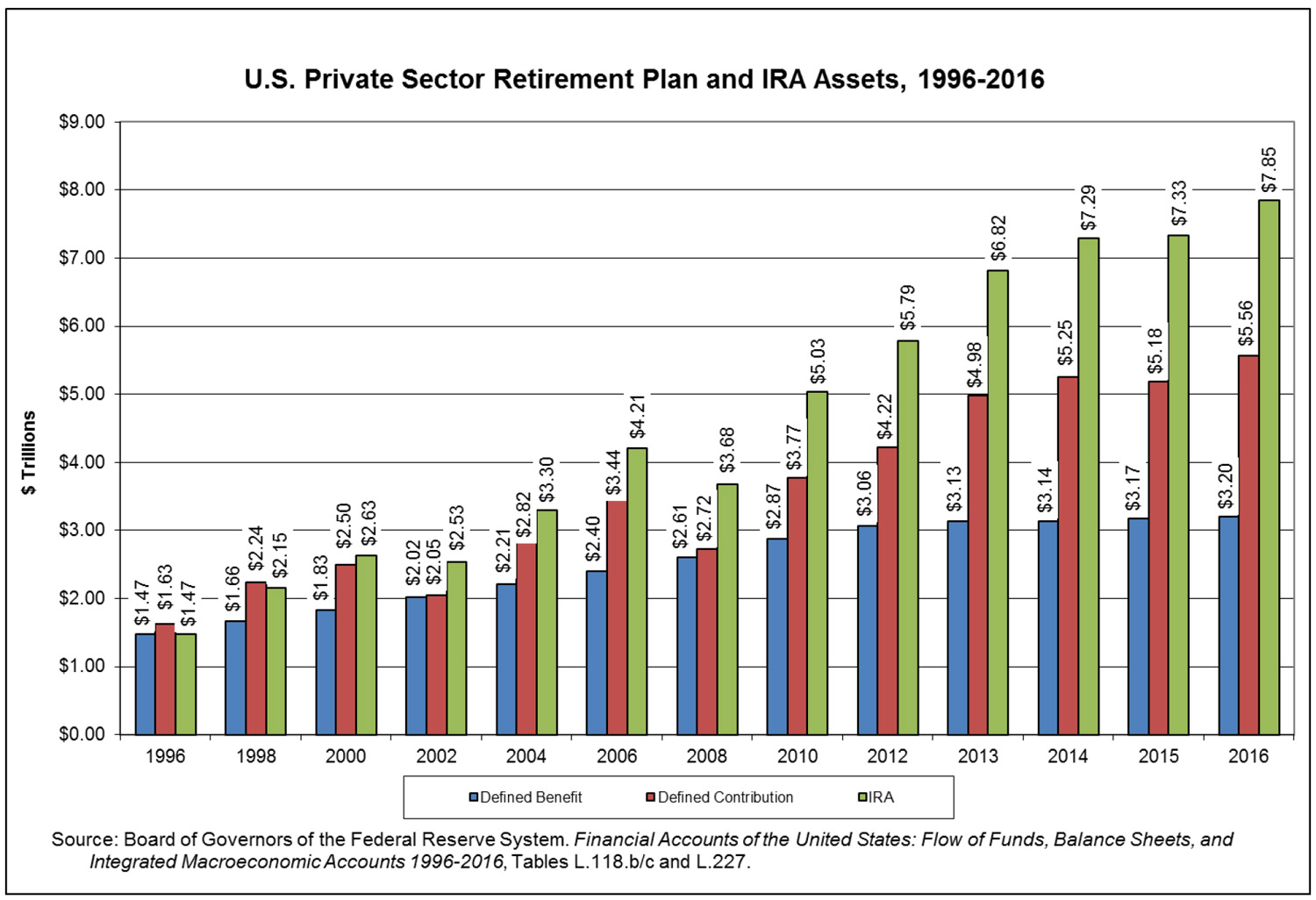

EBRI explains that IRA assets are greater than DC plan assets in large part because of rollovers from DC plans. By 2016, Americans had amassed $7.85 trillion in IRAs versus $5.56 trillion in DC plans. Rollover IRAs had the largest share of IRA assets, at 46.2%, followed by traditional IRAs at 37.5%, Roth IRAs at 14.6% and Keogh plans at 1.75%.

EBRI calls the combination of IRA/Keogh accounts and defined contribution plans "individual account" retirement plans and notes that in 2016 they accounted for 68% of families' financial assets, up from less than 45% in 1992.