Falcon

NOT FOR REPRINT

9 RMD Insights for Tax Season 2024

Slideshow January 29, 2024 at 02:57 PM

Share & Print

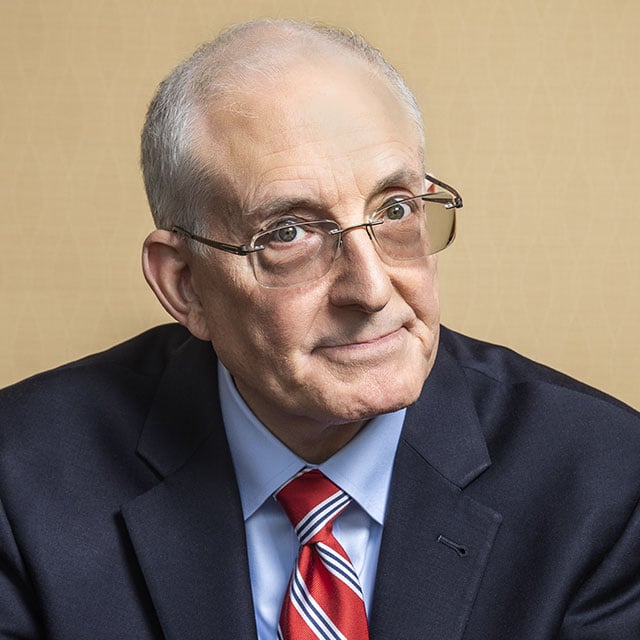

Perhaps no other phase of the retirement planning effort generates as much confusion and consternation for clients as required minimum distributions. The term sounds simple enough, but financial planning professionals with any significant experience supporting retirees will know that accurately calculating, timing and reporting RMDs is no small feat. In fact, Ed Slott, an income planning and tax expert, recently told ThinkAdvisor that RMDs "are confounding advisors this year like never before," thanks to legislative and regulatory changes that have intensified the potential for misunderstanding and mistakes. While Slott and others say that clients now enjoy more flexibility with respect to timing their RMDs, that flexibility is itself a source of ongoing confusion. Fortunately, advisors and their clients have numerous places to turn for quality information about RMDs and tax-efficient retirement income planning, including the ALM Tax Facts library. The accompanying slideshow offers up just a sample of the RMD insights covered by the ever-expanding resource. Advisors who want to dig even deeper can consider signing up for a Tax Facts subscription, which offers access to an archive of planning insights. Premium subscribers gain further access to Tax Facts online plus over 100 interactive calculators and other practice aids to assist with specific client needs.

NOT FOR REPRINT

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.

Featured Resources

View All

Sponsored by Manulife John Hancock Investments

Exploring Private Credit's Journey to a Trillion-Dollar Asset Class