Falcon

NOT FOR REPRINT

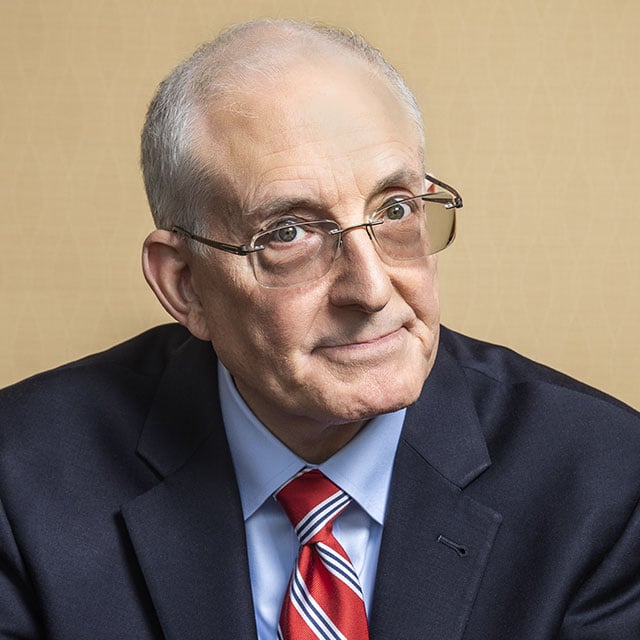

Gundlach: 12 Predictions for Stocks, Bonds, Economy in 2024

Slideshow January 10, 2024 at 02:57 PM

Share & Print

DoubleLine Capital CEO Jeffrey Gundlach sees change and potential upheaval in 2024, including a likely U.S. economic downturn and evolving financial market trends. After strong rallies in late 2023 helped stocks and bonds end the year in positive territory, markets face new challenges as pandemic effects on the economy recede, the billionaire investor suggested. The COVID-19 pandemic "has distorted a bunch of economic data" and made indicators less reliable in the past three years, he said. "But I think that's starting to fade into the background now as we don't have all of this tremendous amount of money printing that's been going on." On a webcast Tuesday and in related posts on X from from DoubleLine, Gundlach also outlined several developments in the credit market. Among these, he said high-yield defaults might increase as lending standards tighten, although it'll probably take a recession for that to happen. Investment-grade credit broadly may yield mid- to high-single digit yields, according to Gundlach. Non-agency residential mortgage-backed securities yields look attractive, while commercial mortgage-backed securities are a mixed bag, with AAA "pretty safe" and Conduit CMBS A- facing defaults, he noted. Check out the gallery for 12 market and economic predictions from Gundlach.

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

Featured Resources

View All

Sponsored by Illinois Mutual Life Insurance Company

4 Reasons To Sell Simplified Issue Disability Income Insurance (SIDI)

Sponsored by Illinois Mutual Life Insurance Company

Simplified Issue Disability Income Insurance (SIDI): A Smarter Way to Sell and Protect