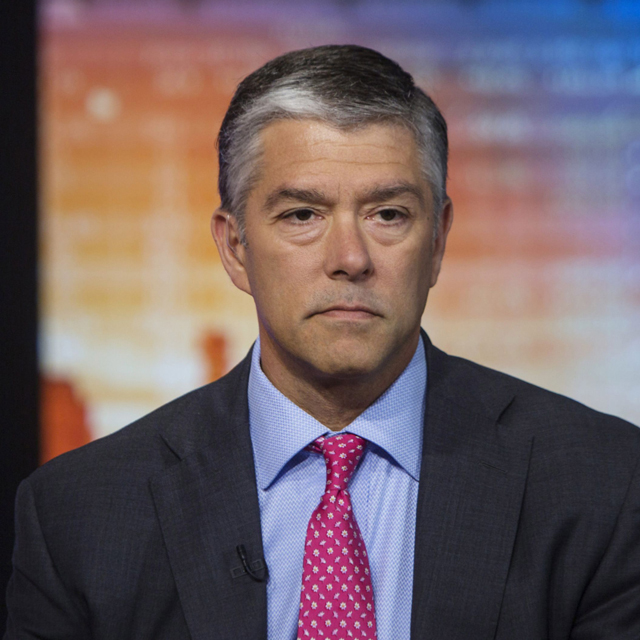

Stocks are likely to endure further volatility in the next few months as more clarity is needed to know when the market has hit bottom, Chris Hyzy, Merrill and Bank of America Private Bank chief investment officer, suggested Monday on CNBC.

After the 60% stock/40% bond portfolio experienced possibly its worst year in 2022, "you're coming into this year and you're looking for a few signs that it's over, and unfortunately, you're not going to see all those signs. That's just not how it works," Hyzy said on "Closing Bell: Overtime."

"You're going to see the hard data turn the other way, the soft data continue to suggest that things are OK, the bond market pricing in one thing, the equity market pricing in another," Hyzy said. "And when you get those two competing forces together and not a lot of clarity, not to mention what's going on with the debt ceiling negotiations and other things around the world, it's a grind.

"So we're at that tail end now where the final bottoming process, everybody's looking for signs. This is the most telegraphed, most debated, discussed recession of all time, perhaps, and now everyone's trying to find the perfect data to suggest it's all over, and we need a few more months and more clarity on what's going to happen in '24 let alone the next few months here in '23."