Falcon

NOT FOR REPRINT

6 Best 'True' S&P 500 Index Funds: Morningstar

Slideshow March 30, 2022 at 09:25 AM

Share & Print

Related: 5 Best and 5 Worst Performing S&P 500 Index Funds: Morningstar

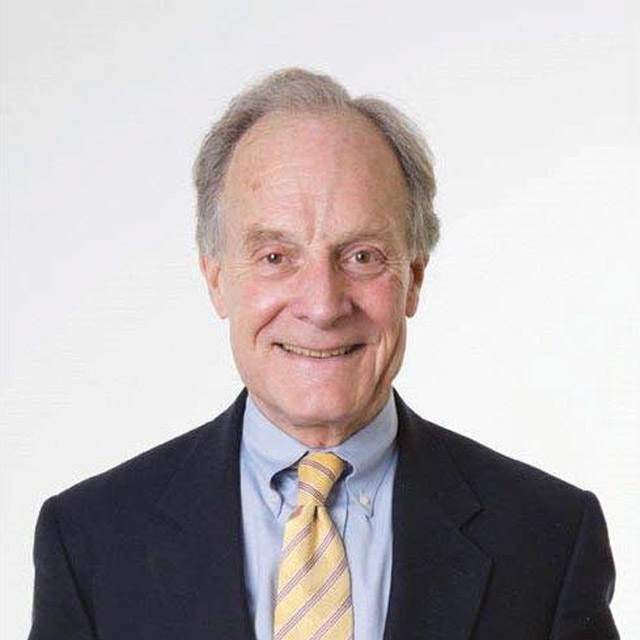

John Rekenthaler, a columnist for Morningstar.com and a member of Morningstar's investment research department, recently went looking in the firm's database for "true" S&P 500 funds, those that are available for retail investors who buy their funds directly. He came up with just 17 products from among the more than 250 funds and ETFs with "500" in their names. Among the rest were offerings that are not conventional S&P 500 funds; they short the market or are leveraged or try to improve on the benchmark. Others roughly echo the S&P 500, but don't try to mimic the benchmark. A lot of these products either sell only to institutions or distribute through financial advisors.The Best Funds

In a new blog post, Rekenthaler discussed the true S&P 500 funds he had identified and how he winnowed those down to the six best ones. He discarded 11 funds from the get-go, as their expense ratios were above 0.05%, a very low cutoff by ordinary standards, he noted. "However, with cheaper options readily available, there's no reason to pay more." Among the remaining six funds, three were mutual funds and three ETFs. Rekenthaler then took into consideration that all index funds wander from time to time. To find out by how much the six funds do so, he measured their deviations by assessing their tracking error. This entailed adding a fund's expense ratio to its reported total return, then comparing this gross return against the benchmark's results and classifying any differences as tracking error. For each fund, he computed the average tracking error over each of the past 10 calendar years. All but one of the finalists routinely landed within a single basis point of their targets. Finally, Rekenthaler calculated each fund's average annualized 10-year return between January 2012 and December 2021. He said discrepancies among the funds' total returns came from the combination of expense ratios and tracking error. He noted that the relationship is not predictable. While expense ratios can only lower a fund's returns, tracking error works in both directions. "Sometimes, when one index fund bests another, the winner deserves blame rather than credit. It erred but got lucky." For his final tabulation of the best funds, Rekenthaler combined the rankings for each of the three criteria: expense ratio, tracking error and total returns. The lowest scoring funds ranked the highest. See the gallery for the six best true S&P 500 funds, according to Rekenthaler.NOT FOR REPRINT

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.

Featured Resources

View All

Sponsored by Axos Advisor Services

Integrated Banking Solutions: How To Enhance Client Services and Grow Your Business

Sponsored by Optifino

Three Macro Trends Impacting Long-Term Care: Trends, Solutions & Client Conversations

Sponsored by Vanilla

The Missing Piece: Why Advisors Who Skip Estate Planning are Failing Their Clients