The Rise and Fall of Ark Invest's Active ETFs

Related: 11 Best Small-Cap Mutual Funds, ETFs: Morningstar

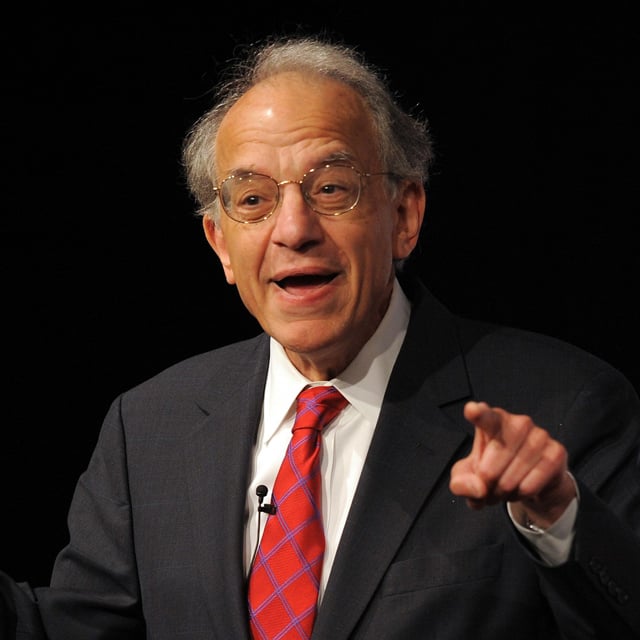

Ark Investment Management was the darling of the ETF market in 2020, but it's one of the market's biggest losers in 2021. Five of the firm's six actively managed equity ETFs are down year-to-date, three of them in double digits, while the large-cap S&P 500 and small-cap Russell 2000 indexes have gained 25.4% and 11.9%, respectively, through Dec. 10. Declines for Ark's five active equity ETFs range from 7.2% for its Space Exploration and Technology ETF (ARKX), launched on March 30, to 34.97% for its Genomic Revolution ETF (ARKG). Its flagship Ark Innovation ETF (ARKK), with almost $18 billion in assets, is down almost 23%. These growing losses led to the launch of an ETF dedicated to shorting ARKK, the Short Innovation ETF (SARK), from Tuttle Capital Management. It is the first ETF focused on shorting another ETF, according to Todd Rosenbluth, head of ETF and mutual fund research at CFRA Research. Since its launch on Nov. 9, SARK has gained 24.4%. During that same period, ARKK shares fell 22.4%. On Thursday, Cathie Wood, the founder and CEO of Ark Invest, told Bloomberg TV that the firm, formed in 2014, is "going through soul searching" having never before experienced losses in its strategies while the broader stock market is appreciating. A day earlier, the firm launched its third index ETF, the Ark Transparency ETF (CTRU), an equal-weighted fund based on an index from Transparency Invest comprised of the "100 most transparent companies in the world." Despite the underperformance of its ETFs, Ark Invest has not suffered large outflows from its funds. Net flows year-to-date through Nov. 30 are positive for all of Ark's active ETFs though negative for the six months ended Nov. 30. "We haven't seen severe net outflows in part because Cathie Wood's charisma continues to captivate retail investors who find her approach and enthusiasm highly inspirational," said Morningstar strategist Robby Greengold. "Most longer-term investors who are targeted by their extensive communication strategy get it," said Dave Nadig, chief investment officer and director of research at ETF Trends. "Nobody ever promised anyone a straight line." Ark Invest has a five-year time horizon for its investments, which Wood frequently reminds investors about. The firm also regularly communicates Ark's analyses of individual holdings and changes in its allocations of holdings. That transparency is "uncommon in active management" and has probably helped the firm retain assets, Rosenbluth said. At the same time, however, that level of transparency, which includes monthly and quarterly webinars about investments and outlooks, as well as Wood's many appearances in the media and at conferences, creates a headwind for the firm, said Morningstar's Greengold. They leave less opportunity for Ark to exploit attractive stocks, investing in them before others do, explained Greengold. Check out the slideshow above to see the performance of Ark's active ETFs this year through Dec. 10, based primarily on Morningstar data. (The performance of ARKX is based on Yahoo Finance data.) They're listed in ascending order by year-to-date performance. (Cover photo courtesy of Ark Invest) — Related on ThinkAdvisor:

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.

Featured Resources

View All

Sponsored by Axos Advisor Services

Integrated Banking Solutions: How To Enhance Client Services and Grow Your Business

Sponsored by Optifino

Three Macro Trends Impacting Long-Term Care: Trends, Solutions & Client Conversations

Sponsored by Vanilla

The Missing Piece: Why Advisors Who Skip Estate Planning are Failing Their Clients