Unum Group executives spent their company's latest earnings call giving securities analysts a sobering look at what COVID-19 did to the people of the United States in the first quarter.

Unum is a major provider of group life insurance, group disability insurance and worker-paid insurance products in the United States and the United Kingdom.

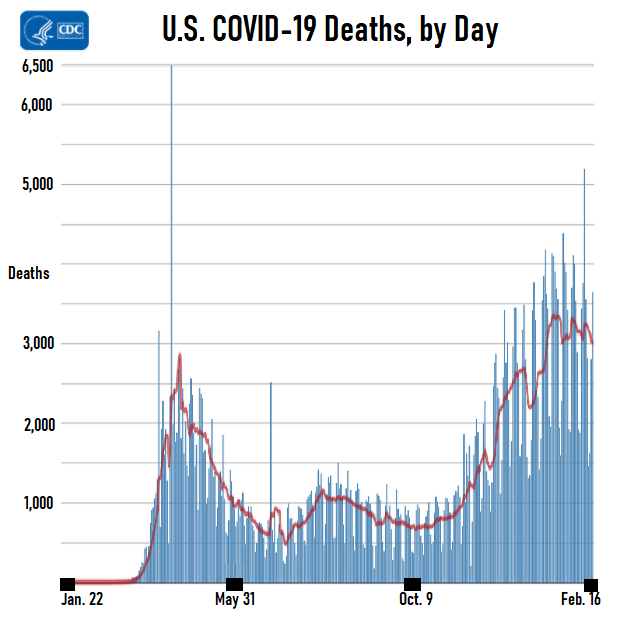

Unum turned a profit in the first quarter, and company executives said they expect vaccines to help reduce the number of pandemic-related U.S. deaths to fewer than 60,000 in the second quarter, from about 200,000 in the first quarter.

Even in the first quarter, conditions improved dramatically after the first few weeks.

"While the human loss from the pandemic continues to be heartbreaking for all of us, COVID-19-related mortality across the U.S. has been trending favorably on a weekly basis from peak levels in December and January," Richard McKenney, Unum's CEO, said during the call. "Our own results mirror these week-to-week improving trends that you see in national statistics, and we look forward to improved results in our life insurance lines, beginning in the second quarter and accelerating further into the second half of 2021."

But in January, the effects of COVID-19 on the people Unum insures were painful.

The pandemic "has generated higher volumes of short-term disability claims and leave requests in the workplace," McKenney said.

Steven Zabel, the company's chief financial officer, told analysts that Unum's Unum US unit expects to receive about one group life insurance claim for every 100 excess U.S. COVID-19 deaths. That rule of thumb worked in the first quarter, and Unum US received about 2,050 COVID-19-related claims, with an average claim of about $50,000, he said.

The number of deaths not attributed to COVID-19 was also higher, but the average claim for those deaths was lower, and the increase in non-COVID-19-related deaths had little effect on results, Zabel said.

Group Life and AD&D Numbers

Unum's Unum US earnings supplement shows that group life and accidental death and dismemberment (AD&D) premium income fell slightly during the quarter, to $410 million, from $415 million.

Mainly because of COVID-19-related life insurance claims, benefits spending at the unit increased to $446 million, up 39% from the total for the first quarter of 2020.