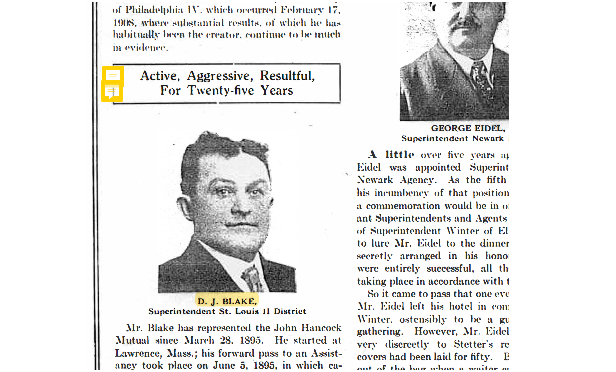

Daniel J. Blake, in 1920. (Credit: The John Hancock Field)

Daniel J. Blake, in 1920. (Credit: The John Hancock Field)

The DeLorean sports car of memory rushes me back through the decades. Back through the 2010s, through the 2000s, through the 1990s… all the way to June 1961.

John Kennedy is president. Fashionable people are wearing hats. IBM is preparing to release its first Selectric typewriter.

I'm a trainee at the insurance agency my dad, Jim Blake, is managing for a major life insurance company.

The Way Becoming an Agent Was

In June 1961, I was age 18, and I had just finished my sophomore year at Rockhurst College (now Rockhurst University) in Kansas City, Missouri. Back then, all I could think about was becoming a successful provider of insurance products and services, for existing office leads customers and, hopefully, new clients of my own. Of course, I was clueless about the what, the when, and the how of how I was going to accomplish this feat.

In the mornings, at the agency, I took a correspondence study course to learn the insurance business. In the afternoons and evenings, I went on calls and appointments with the top agent, Thomas V. Lynch. Tom Lynch was, and is, a master salesman, very smart, and a real professional. Although he and his family now live in Minneapolis, we are still very close friends and confidants to this day. Tom became known as one of the most able estate planners in the country.

Here are two concepts I learned that summer.

The first concept was the value of building a clientele.

(Related: Renewals, Renewals, Renewals)

I learned this by seeing how Tom interacted with his clients. Tom was very important to them. He showed how important an Insurance Agent could be to families and businesses. An Insurance Agent can provide the client with a real piece of property, which pays a set amount of dollars at the death of a family's breadwinner, or at the death of a key person at a business. What a truly remarkable asset for protecting families and businesses.

Although, the insured clients would be deceased, if they were still alive, they would have been proud to know they had made these strong arrangements for protecting their families and businesses.

Providing this fine insurance product and the service that goes along with it affected me in such a positive way. It's one of the reasons I've been in this business my whole adult life.

The second concept that caught my attention was the value of renewal commissions.

My dad literally sold me on the idea that renewal commissions were the most important part of my compensation as an Insurance Agent. This was the sizzle for me, because renewals were (yes! I used the past tense 'linking verb' were) truly such a unique component in our compensation program back then. We had such a diamond, so I thought!