State Insurance Regulators Hold Session on Race and Insurance

Resources

- Links to NAIC summer meeting resources, including links to resources related to the special session on race and insurance, are available here.

- An earlier article about Nichols' views is available here.

The History

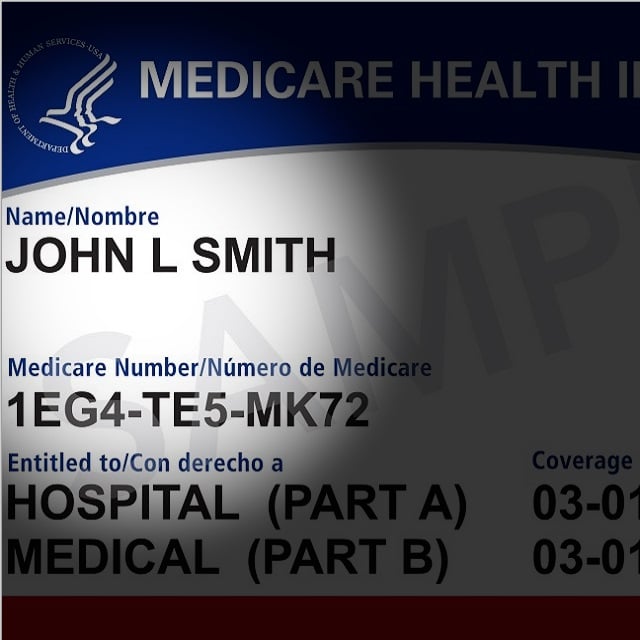

Leroy Nunery II, a strategic advisor who created a major 2017 report on African American insurance professionals for Marsh, said that insurance has long played an important role in the U.S. Black community, and that some of the earliest issues of The Crisis Magazine, the official publication of the National Association for the Advancement of Colored People, featured ads placed by Black-owned mutual insurance companies. Nichols, the American College president and former NAIC president, said that U.S. insurers also played a role in institutionalizing discrimination against Black people, by selling them life insurance policies that cost 30% to 40% more than the policies sold to comparable white people and provided only 60% as much coverage. The Civil Rights Act of 1964 prohibited that kind of race-based pricing, but, over the years, many insurers kept the prohibited race-based pricing arrangements in place, Nichols said. Nichols noted that regulators looked into that problem several times and that, finally, when he was the NAIC's president, insurers eliminated the provisions and agreed to $556 million in settlements. Today, Nichols said, the American College and life insurers are trying to address the effects of that kind of discrimination by taking steps to promote financial literacy among Black families; improve executive development programs for members of underrepresented groups; and hire more members of underrepresented groups at all levels.

The Regulators

Regulators also talked about their perceptions of discrimination, and about what they can do to improve the situation. Mike Chaney, Mississippi's elected insurance commissioner, who is a Republican, said he feels as if he has only limited ability to shape the actions of large insurers. He said he has tried to encourage insurers to recruit more minority agents, and that he has tried to make sure that insurers aren't using artificial intelligence and "big data" to discriminate unfairly against older people, members of minority groups, or other people. "A lot of this data is coming from third parties, and we're not sure it's correct," Chaney said. "But it's being used." Ricardo Lara, the California insurance commissioner, said his department has been looking at the possibility that activities that don't appear to involve race could lead to unfair discrimination. The department found, for example, that auto insurance affinity group discount programs may lead to white people getting lower prices than Black motorists with similar driving records, Lara said. — Read How the First Black CFP Built His Practice, on ThinkAdvisor. — Connect with ThinkAdvisor Life/Health on Facebook, LinkedIn and Twitter.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

Featured Resources

View All

Sponsored by Illinois Mutual Life Insurance Company

4 Reasons To Sell Simplified Issue Disability Income Insurance (SIDI)

Sponsored by Illinois Mutual Life Insurance Company

Simplified Issue Disability Income Insurance (SIDI): A Smarter Way to Sell and Protect