Falcon

NOT FOR REPRINT

10 Most Painful Stock Market Crashes of All Time: Morningstar

By

Ginger Szala

Slideshow April 29, 2020 at 03:51 PM

Share & Print

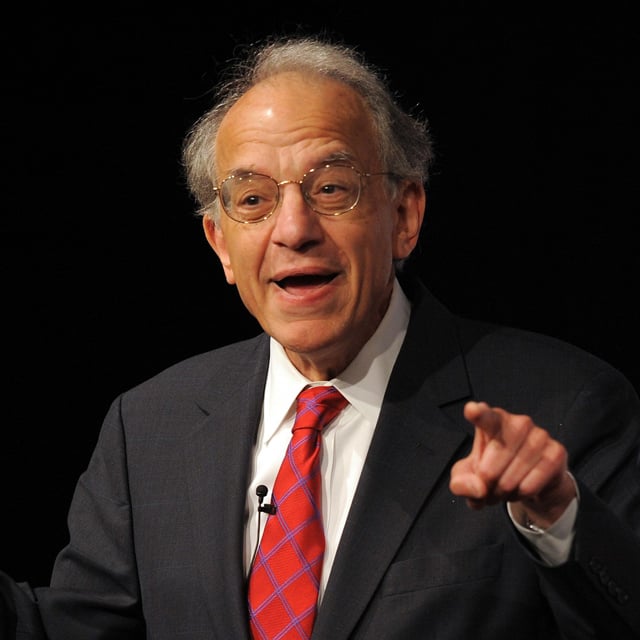

Morningstar Canada's director of research, Paul D. Kaplan, wanted to determine what prior market crashes could teach us about the current one, so he calculated a "Pain Index" that looks at 150 years in market drops and defines what makes them different, from let's say, the mother of all market falls, the 1929 crash and Great Depression. The Pain Index's purpose is to measure severity of each market crash via degree of the decline and how long it took to get back to the prior stock market high or cumulative level. The coronavirus crash was significant — the S&P 500 dropped 34% by March 23 from its all-time highs in February. While it has climbed more than 25% since then, it will take some time to see if the market has really quit falling and if so, how long it will take to get back to the original high of roughly 3,393. The Pain Ratio for each market drop, or episode, is the ratio of the area between the cumulative value line and the peak-to-recovery line, compared with that area for the worst market decline in the past 150 year — the 1929 crash and first part of the Great Depression, which scores 100% on the Pain Index. Check out the slideshow to see how close other market crashes came to that level of severity, according to Kaplan's calculations. --- Related on ThinkAdvisor:

NOT FOR REPRINT

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.

Featured Resources

View All

Sponsored by Axos Advisor Services

Integrated Banking Solutions: How To Enhance Client Services and Grow Your Business

Sponsored by Optifino

Three Macro Trends Impacting Long-Term Care: Trends, Solutions & Client Conversations

Sponsored by Vanilla

The Missing Piece: Why Advisors Who Skip Estate Planning are Failing Their Clients