In an article titled, "Four Reasons Whole Life Insurance Is Not Worth It," Holly Johnson, writing in The Simple Dollar, confidently tells readers:

"Instead of pouring money into a whole life insurance policy and hoping it pays off, I would much rather keep more of my money in my own hands. That way, I can continue saving cash, maxing out our retirement accounts, and investing in real estate."

Sad is the fact that she was taught erroneous information about how whole life insurance works. But, perhaps even sadder is the fact that her confidence about that, which doesn't come without great expense and, perhaps, a valuable life lesson.

For years, critics have confused people about the essential nature of whole life insurance, and investors have paid a terrible price for that advice in both excessive risk and sub par investment returns compared to a strong participating whole life insurance policy.

Especially damaging is the advice from trusted consumer advocacy groups, like Consumer Reports. A 2015 Consumer Reports article titled "Is whole life insurance right for you" advises its readers:

"If you're wealthy, you can probably gamble on whole life… If you're struggling, go with term."

Indeed, Johnson cites that article in her article as an authoritative source of information about whole life insurance. But, as I discussed in an earlier blog post, such information and advice is not serious, and cannot be serious, nor is it truly helpful to the vast majority of individuals seeking financial security and independence.

(Related: Whole Life Insurance Critics Aren't Serious)

That financial advisors remain ignorant — whether innocently or otherwise — about how whole life works is a travesty of the highest order.

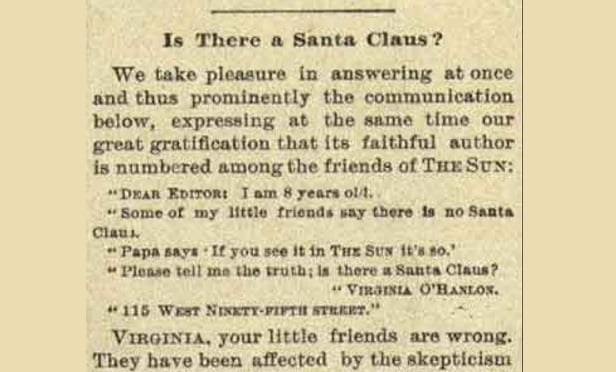

A quick trip down memory lane reveals the advice given to eight-year-old Virginia O'Hanlon in 1897 by the New York Sun about Santa Claus is strangely relevant here:

"Virginia, your little friends are wrong. They have been affected by the skepticism of a skeptical age. They do not believe except they see. They think that nothing can be which is not comprehensible by their little minds."

Clients need to hear, in unequivocal language, "Yes, whole life insurance is worth it." That their skeptical friends and advisors are wrong, and that they can trade in their fears, doubts, and uncertainties, with safety, protection, and certainty.

Indeed, the essential nature and unsaid truth of whole life insurance is so obvious and straightforward, it's often missed by those looking for complex financial solutions and those willing to sell complex financial plans to their clients.

The Unsaid Truth About Whole Life Insurance

Contra Consumer Reports, whole life insurance is not a "gamble." Point of fact, it is the complete opposite of gambling. Life insurance companies sell certainty. Prospective policyholders come to insurance companies with an uncertain financial future. They trade that great unknown for a known premium and guaranteed future outcome. Life insurance companies are willing to make 30, 50, even 100-plus year promises (for especially young insureds) in exchange for said premium.

No other financial institution makes such long-dated promises because no other financial institution is in a financial position to do so.

This is why whole life insurance is potentially the single-most valuable long-term financial product available to consumers. Among the various financial products available which offer something resembling a guarantee to investors, none offer a lifetime guarantee of savings, a lifetime guarantee of a death benefit which is higher than the savings amount, and a reasonable expectation of dividend income.