Medicare Managers Update Their Plan Finder

A Sleek New Look

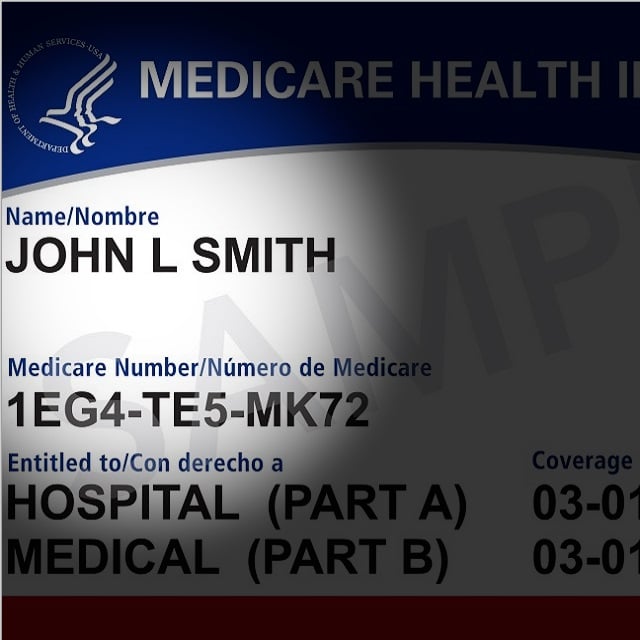

Consumer groups have long complained that the old Medicare Plan Finder was ugly and too complicated for consumers to understand, and that it lacked some of the information that consumers needed to compare plans. The site update, which was unveiled in August, has given the system a sleek new look. Consumers can use the new site on their phones, and consumers can use it to compare the cost of Medicare Advantage plans with the cost of combining what CMS calls 'Original Medicare' coverage with Medicare supplement insurance. The site is supposed to feed consumers' prescription drug history straight into the shopping tool, to help them compare how well different plans cover "their" drugs.

(Many) More Steps

Critics say that, in practice, the new system forces producers to re-enter consumers' prescriptions one at a time, through a painfully slow process, each time producers help the consumers, rather than simply letting them store and re-use the drug lists, or giving them a quick process to snap a consumer's prescription list in at the start of a shopping session. One key type of consumer out-of-pocket cost estimator that was available on the old system — a tool that ranked plan results by total estimated out-of-pocket costs, including deductibles, co-payments and premiums — has not yet been available on the new system. Producers can help clients sort by premium level, and deductible level, but not by the client's total anticipated cash outlays. Producers say that, in many cases, just a few days before the official start of the annual enrollment period, the results lists are available appear to be sorted in the wrong order. Jeff Conyers, an agent in North Carolina, said Wednesday in an email interview that helping a Medicare client today, and re-entering each client's prescriptions one at a time, "is exponentially more time-consuming." "In addition, there are more blanks to fill to complete the process," Conyers said. If an agent tries to perform different kinds of searches, such as searches for clients who insist on brand-name drugs and those who are willing to consider generic drugs, "the system now requires that you open a new search and start from scratch," Conyers said.

The Response

The Center for Medicare Advocacy, a nonprofit group with close ties to state Senior Health Insurance Program offices, is one of the groups that has asked CMS to do something. The National Association of Insurance and Financial Advisors and the National Association of Health Underwriters have been working on the problem. The same kinds of insurance marketing organizations (IMOs) and web brokers that helped agents cope with HealthCare.gov problems are seeing the new Medicare Plan Finder problems as an opportunity to shine. Organizations such as Senior Market Sales Inc. and Health Sherpa are telling agents that they have tools that can help agents overcome concerns about the Medicare Plan Finder update. CMS has said that it plans to roll out at least some of the requested changes, such as a return of the total out-of-pocket cost ranking tool, soon. — Read 10 Top States for 2020 Medicare Advantage Capitation Payment Increases, on ThinkAdvisor. — Connect with ThinkAdvisor Life/Health on Facebook, LinkedIn and Twitter.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

Featured Resources

View All

Sponsored by Illinois Mutual Life Insurance Company

4 Reasons To Sell Simplified Issue Disability Income Insurance (SIDI)

Sponsored by Illinois Mutual Life Insurance Company

Simplified Issue Disability Income Insurance (SIDI): A Smarter Way to Sell and Protect