Medicare Plan Home Care Benefits Could Work: State Official

The Background

Widespread adoption of any of the LTC finance proposals could have a big effect any advisors who are using annuities, investment products, or other arrangements to help clients manage long-term care risk. In the 1980s and early 1990s, when commercial insurers were enthusiastic about the stand-alone long-term care insurance market, insurers fought to keep long-term care benefits out of Medicare. Today, private Medicare plan LTC benefits proposals sit to far to the right of some other widely discussed long-term care finance proposals. One Democratic presidential contender, Cory Booker, has proposed a big increase in eligibility for Medicaid nursing home benefits. He would increase the Medicaid nursing home benefit eligibility limit for a couple to an annual income limit of about $49,380, and an asset cap of about $200,000. Bernie Sanders, has proposed having the government pay for all long-term care and banning the sale of private insurance that would pay for long-term care services.

The Minnesota EHC Proposal

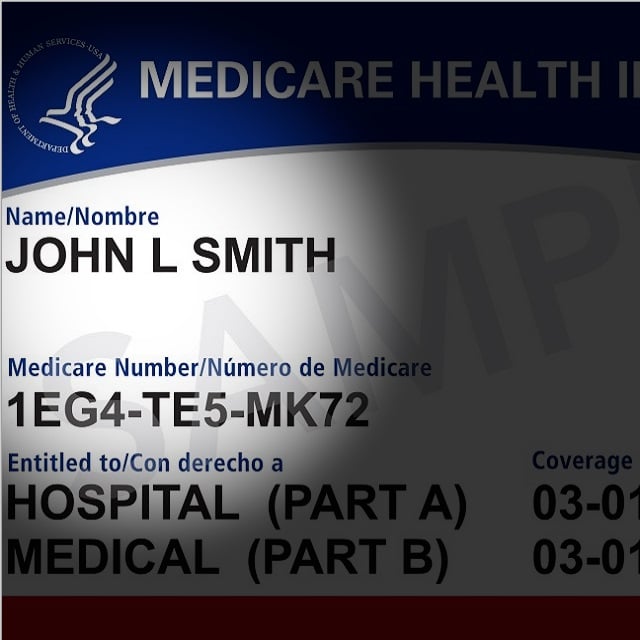

Minnesota officials are considering a benefit that would be added to all Medicare Advantage and Medicare supplement (Medigap) insurance policies. The benefit would pay for home care for enrollees Medicare-approved to receive home medical care. The benefit would be available to any Medicare enrollee, without means testing or age limitations. Making the benefit mandatory would help make home care coverage almost universal, according to another slidedeck, prepared by John Cutler, a long-term care policy specialist, that was posted in December 2018.

Medicare Plan LTC Alternatives

Knatterud also talked about a number of other long-term care finance ideas, including the new Centers for Medicare and Medicaid Services (CMS) rules that let issuers of Medicare Advantage plans add small amounts of coverage for adult day care, homemaking services, and other non-medical care. CMS added some flexibility for 2019. Because the flexibility came late in the planning, few Medicare Advantage plans are doing much with that flexibility, Knatterud said. New rules for 2020 will let Medicare Advantage plans added non-medical benefits aimed at people with serious, complex medical conditions, Knatterud said. At this point, the most popular benefits appear to be caregiver support services, in-hope support, social worker phone lines, and adult day care, Knatterud said. — Read Medicare Lets Agents Market PACE Home Care Plans, on ThinkAdvisor. — Connect with ThinkAdvisor Life/Health on Facebook, LinkedIn and Twitter.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

Featured Resources

View All

Sponsored by Illinois Mutual Life Insurance Company

4 Reasons To Sell Simplified Issue Disability Income Insurance (SIDI)

Sponsored by Illinois Mutual Life Insurance Company

Simplified Issue Disability Income Insurance (SIDI): A Smarter Way to Sell and Protect