(Photo: Russ Bryant/Georgia Historical Society)

(Photo: Russ Bryant/Georgia Historical Society)

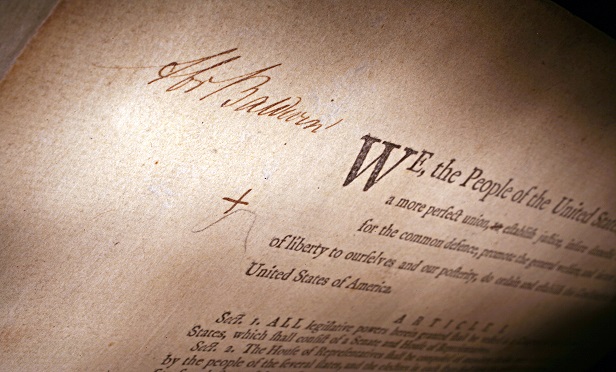

Remember that civics class you had to take in high school? If so, you might recall that the federal government possesses only those powers delegated to it by the U.S. Constitution. All remaining powers are reserved for the states or the people.

This is the main principle of the 10th Amendment to the Constitution. And for approximately 240 years, there has been a healthy tension between the states and federal government with respect to the authority and role of each.

A review of history teaches us that the founding fathers struggled with the tension that exists between states' rights and a federal government. James Madison and Thomas Jefferson were both advocates for small and limited federal government. Both feared that a large central government would be too close to a monarchy. Alexander Hamilton, whom many suspected of being a monarchist at heart, favored a larger central government. Hamilton feared local democracy because it would allow control by the "masses."

Since its ratification in 1791 there has always been issues between states' rights and federal authority. However, over the past 10 years, the tension between the states and federal government has risen dramatically. We are now witnessing the impact of this tension on many policy issues, from sanctuary cities and immigration to health policy (Medicaid, Affordable Care Act) and pro-life/pro-choice policies.

How is this relevant to the employee benefits industry?

The Affordable Care Act (ACA) is illustrative. The federal government enacted a broad law imposing many new requirements on both individuals and states. Many states resisted the implementation of key elements of the ACA and sued in federal courts to either stop or limit the implementation. On one key issue the states were successful: the Medicaid expansion provisions of the ACA, which punished states for not adopting the federal rule by reducing other federal money.

Ruling with the 10th Amendment in mind, the U.S. Supreme Court noted that the federal government is not permitted to "put a gun to the head" of the states to achieve federally mandated results.

Perry Braun

Perry Braun