Over the course of the past few months, we have dissected the performance and risk and discussed the benefits and potential pitfalls of ESG investing. In our final ESG piece, we look at the growing popularity of ESG investing and look at some of the top performing ESG managers in this space.

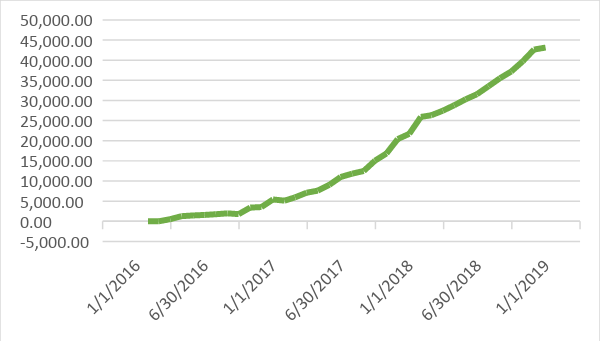

Figure 1 — Cumulative SRI/ESG fund net inflows, in millions. (Source: EPFR Global)

Figure 1 — Cumulative SRI/ESG fund net inflows, in millions. (Source: EPFR Global)

Following the lead of communities and individuals, environmental responsibility and reducing carbon footprints have gained great corporate momentum over the past few years. This momentum has resulted in increasing investor demand for investment products that focus on environmental, social, and corporate governance (ESG) standards. Asset management companies have followed suit by increasing the number of ESG strategies that they offer, which has resulted in an influx of new assets. According to Morgan Stanley Institute for Sustainable Investing and Bloomberg L.P., one quarter or $12 trillion of U.S. assets under professional investment management are considering environmental, social and corporate governance principles.

According to EPFR Global, investors continue to pour money into mutual funds and ETFs focused on ESG and socially responsible investing. (Figure 1). During the three years ending 2018, all SRI/ESG themed equity funds attracted over $43 billion in net inflows.

Taking a closer look, SRI and ESG themed funds attracted flows ranging from 5.2% to 73% of assets under management (Figure 2). Meanwhile, outside the emerging markets equity group, all other funds experienced outflows as a percentage of assets under management during the year.

Figure 2 — Source: EPFR Global, 2018 net inflows. All funds versus SRI/ESG only funds, in % of AUM terms

Figure 2 — Source: EPFR Global, 2018 net inflows. All funds versus SRI/ESG only funds, in % of AUM terms

In a 2018 survey from Morgan Stanley Institute for Sustainable Investing and Bloomberg L.P., over 300 U.S. asset management professionals provided insight on the driving forces behind the demand for SRI/ESG investing. Three-quarters of the respondents said their firms had adopted sustainable investing, up from 65% in 2016. Meanwhile, 29% of the survey participants said their firms were adopting ESG strategies to capture new assets under management, followed by high growth potential (29%), because investors expect it (26%), for the well-being of the environment (26%), and to demonstrate integrity (24%).

Figure 3 — Source: Informa Financial Intelligence Zephyr platform

Figure 3 — Source: Informa Financial Intelligence Zephyr platform  Ryan Nauman is a Market Strategist for Informa Financial Intelligence's Zephyr. His market analysis and commentaries are available at

Ryan Nauman is a Market Strategist for Informa Financial Intelligence's Zephyr. His market analysis and commentaries are available at