Falcon

NOT FOR REPRINT

Why a Cannabis-Focused Investment Manager Likes These 10 Companies

By

Emily Zulz

News February 13, 2019 at 04:30 PM

Share & Print

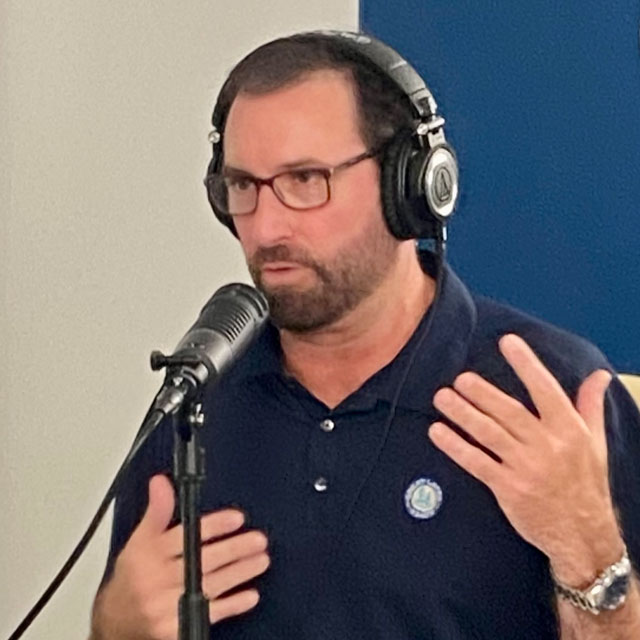

Todd Harrison of CB1 Capital expects that before long every registered investment advisor is going to need to invest 3-5% of their book in cannabis as a growth area. During a session at the Investments & Wealth Institute's Investment Advisor Forum in Midtown Manhattan, Harrison framed the opportunities in cannabis as an investment class and shared insights on what he sees as an emerging force in health care. "This is not about getting high, this is about wellness disruption," he told the overcrowded room. Harrison is the founding partner and chief investment officer of CB1 Capital, which is an investment manager that, according to its website, "specializes in the supply chain of cannabinoid-based wellness solutions, products and therapies that address a wide range of unmet medical conditions, or have commercial use cases." According to Harrison, most analysts on the street still view cannabis as a social lubricant versus an entirely new drug delivery platform. "When people figure out this is disruptive health care, that this is wellness, that this is something that's good for you, we think that all of the above — banks, insurance companies, pension funds, investment advisors — are going to bum-rush this space." Looking at the opportunities in cannabis, Harrison said that right now cannabis is a $300 billion market as a cash crop. However, this market consists primarily of dry flower and doesn't account for the oncoming market of diverse consumer packaged goods. As more regulated markets open up, consumption rates should significantly grow as new consumers are exposed to cannabinoids across new distribution networks, according to Harrison. "A lot of people out there are looking at that $300 billion and saying that's the addressable market," Harrison explained. "We look at cannabis and we say these are ingredients." In addition to the cash crop, Harrison believes that introducing cannabis as an ingredient into other products will lead to a $2 trillion global market cap in about a decade. "We're talking about a global market cap that went from $300 billion to $2-3 trillion over the next decade; I don't know [a sector] that has that type of growth potential out there," he said. Harrison then identified 10 companies and positions that CB1 Capital finds attractive when looking at cannabis as an investment class. These are all positions of CB1 Capital, which include Canadian licensed providers, U.S. multi-state operators, Australian providers and biotech companies. ---Related on ThinkAdvisor:

NOT FOR REPRINT

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.

Featured Resources

View All

Sponsored by Axos Advisor Services

Integrated Banking Solutions: How To Enhance Client Services and Grow Your Business

Sponsored by Optifino

Three Macro Trends Impacting Long-Term Care: Trends, Solutions & Client Conversations

Sponsored by Vanilla

The Missing Piece: Why Advisors Who Skip Estate Planning are Failing Their Clients