Falcon

NOT FOR REPRINT

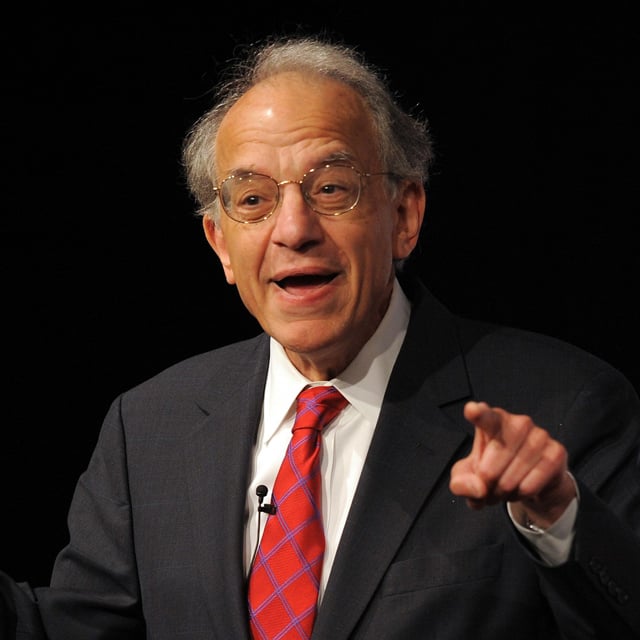

Bob Doll's 10 Predictions for 2019

Slideshow January 04, 2019 at 03:39 PM

Share & Print

(Related: Bob Doll's 10 Predictions for 2018) Bob Doll, chief equity strategist at Nuveen, is forecasting positive returns for U.S. stocks and even higher returns for non-U.S. equities in 2019 following declines in both in 2018. Those are just two of Doll's top 10 predictions for the year, which he offers every year along with a midyear update. "The biggest question for markets is whether the U.S. is heading into a recession," writes Doll. "Recessions are inevitable, but we think one is unlikely to commence in 2019. If we're right, equities will probably see gains over the next 12 months. If we're wrong, it will be a tough year for the markets and for our predictions." (Related: Gary Shilling Sees 66% Chance of Recession in 2019) In either case, Doll expects "markets will remain choppy and frustrating and stocks will bounce around with extended runs and declines," not unlike the stock market's performance in recent months. He expects "2019 will be a difficult environment for investors" because volatility will remain "elevated." Doll says 2,650 is a "reasonable year-end target range for the S&P 500." That is about 5% above its level in late afternoon trading on Thursday. Several of Doll's predictions for 2019 represent an extension of recent trends or confirmation of current expectations. The U.S. expansion is already the second longest in history, the Treasury yield continues to flatten and tensions between the U.S. and China and between Democrats and Republicans continue with no signs of abating or compromise, for example. Doll's top 10 predictions for 2018 proved to be about 80% correct. His biggest miss: equities beating bonds for the seventh consecutive year. Bonds and even cash beat major equity indexes in 2018 due to steep stock declines in the last few weeks of the year. After falling almost 9% in December — the worst December since 1931 — the S&P finished 2018 down 6.2%. Check out the gallery above to see Doll's 10 predictions for 2019. --- Related on ThinkAdvisor:

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

Featured Resources

View All

Sponsored by Laserfiche

Did you know 55% of leaders prioritize cost reduction and productivity in data management?