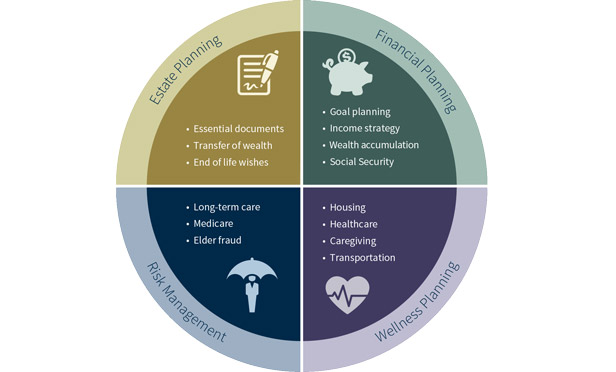

Raymond James' Longevity Planning Wheel.

Raymond James' Longevity Planning Wheel.

If you're an advisor whose main value to clients is investment management, you may be in trouble. If you're one of the 7,500 advisors who affiliate with Raymond James, you've got a new lifeline.

For all RJ-affiliated advisors–RIAs, independent contractors or employee-advisors—a new suite of longevity planning tools allows you to provide solutions to aging clients (and their families) on some of the most complicated, important choices that they must make. Those solutions have another benefit to advisors: they'll help retain clients, perhaps attract new clients through referrals, all while justifying the fees you charge.

Frank McAleer, senior VP of Wealth, Retirement and Portfolio Solutions at Raymond James, puts it bluntly on the fee justification issue. "Fee compression is upon us: that's the cold, hard truth," citing the success of Vanguard and Schwab in gathering hundreds of millions of dollars in their robo-advisor platforms over just three to four years.

Frank McAleer

Frank McAleer

"Some will say it's not affecting their business, yet. But when a client inevitably comes to you and asks, 'I can go to Vanguard and pay 35 basis points, so what are you doing that's worth more than 35?' " McAleer says, "You can point to what we call our longevity planning wheel and say, 'These are the resources that we've vetted out, that we can provide to you on a discounted basis, that we can educate you on, that we can help you plan for.' That's a lot different than just managing money. It's a further rationalization of the value a human advisor can provide."