Due to continuing market volatility, a tactical investment approach has been gaining increasing attention. One of the goals advisors should have is educating their clients on those two different approaches–tactical and strategic. There is no universal solution for all clients and each situation is unique but educating clients on different investment approaches is essential to help clients to meet their long-term objectives. In this month's article, we take a closer look at investment products and investment styles that investment advisors used in their clients' portfolios.

Investment Management: Product

In today's markets, advisors must spend more of their time staying abreast and protecting clients against volatility. But even as RIA firms have been dealing with near-term market dislocations, other longer-term trends have been continuing to take shape, some of which are helping build and sustain advisors' businesses.

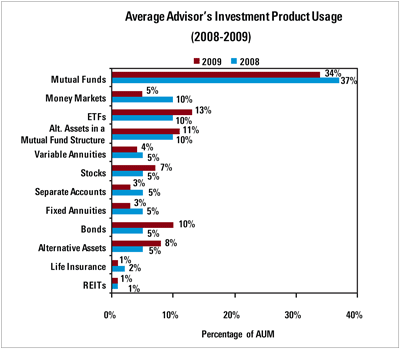

For several years, advisors have been diversifying away from traditional mutual fund choices (Exhibit 1). In their place, we have seen steady growth in the use of ETFs, alternative style mutual funds and alternative assets. In 2008, we also saw a spike in the use of money market funds, as advisors parked clients' money in cash–a trend that nearly fully reversed in 2009.

What these trends suggest, especially in light of the shift toward tactical investing, is that advisors are searching for new solutions to address market volatility, risk and cost. ETFs and alternative style mutual funds can offer lower investment cost compared to traditional products, such as equity and bond mutual funds, and private hedge funds, respectively. They may also improve liquidity and flexibility to support a more opportunistic approach to investing.

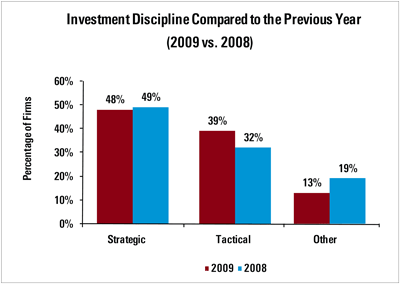

Also in 2009, we saw a slight shift from strategic to tactical management of client portfolios, as advisors tried to cope with extreme market volatility and a very uncertain economic climate.